Rideshare Driver Insurance Requirements: A Comprehensive Guide

As rideshare services like Uber and Lyft continue to gain popularity, it is essential for drivers to understand the insurance requirements they must meet. Whether you are a new rideshare driver or considering joining the industry, this blog article will provide you with a detailed and comprehensive guide on the insurance requirements you need to fulfill.

In this article, we will cover everything you need to know about rideshare driver insurance, including the types of coverage required, policy limits, and how to ensure you are adequately protected. By the end, you will have a clear understanding of the insurance obligations and how to navigate through them as a rideshare driver.

Personal Auto Insurance and Rideshare Driving

Rideshare driving involves using your personal vehicle for commercial purposes, which can have implications on your personal auto insurance policy. It is crucial to understand how your personal auto insurance coverage interacts with rideshare driving and what gaps you need to fill.

1. Personal Auto Insurance Exclusions

Most personal auto insurance policies exclude coverage for activities that are considered commercial, such as transporting passengers for hire. This means that if you get into an accident while driving for a rideshare company, your personal auto insurance may deny coverage, leaving you personally responsible for any damages or injuries.

2. Personal Auto Insurance Endorsements

To address the coverage gaps, many insurance companies now offer rideshare endorsements or add-ons that can be added to your personal auto insurance policy. These endorsements extend your coverage to include rideshare driving. However, it is important to note that not all insurance companies offer this option, so it's essential to check with your provider or shop around for a policy that includes rideshare coverage.

3. Rideshare Gap Coverage

Even if you have a personal auto insurance policy with a rideshare endorsement, there may still be gaps in coverage during certain periods of rideshare driving. For example, when you are waiting for a ride request or driving to pick up a passenger, your personal auto insurance may not provide coverage. In these situations, rideshare gap coverage can help fill the gaps and ensure you are protected.

4. Commercial Auto Insurance

If your personal auto insurance provider does not offer rideshare endorsements or if you want more comprehensive coverage, you may consider purchasing a commercial auto insurance policy. Commercial auto insurance is specifically designed for businesses and can provide coverage for your rideshare activities. However, commercial auto insurance tends to be more expensive than personal auto insurance, so it's important to weigh the cost against the benefits.

Rideshare Company Insurance

Rideshare companies like Uber and Lyft provide insurance coverage for their drivers, but it is important to understand when this coverage applies and what it entails.

1. Periods of Rideshare Driving

Rideshare driving can be divided into different periods, each with different insurance coverage. Understanding these periods is crucial to know when you are covered by the rideshare company's insurance and when you need to rely on your own coverage.

2. Period 1: App Off

During this period, when you are not logged into the rideshare app and waiting for a ride request, your personal auto insurance will be your primary coverage. Rideshare companies typically do not provide insurance coverage during this time.

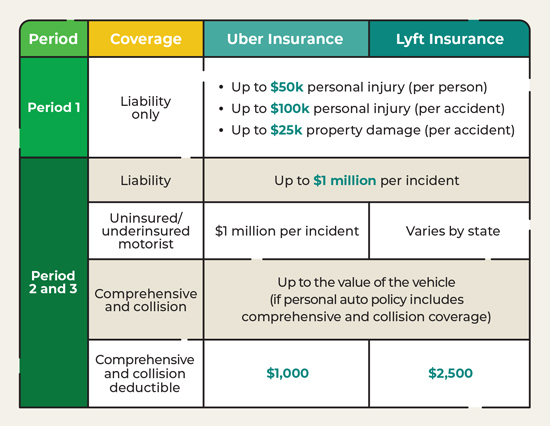

3. Period 2: App On, No Passenger

Once you are logged into the rideshare app and waiting for a ride request, but have not yet picked up a passenger, the rideshare company's contingent liability coverage typically applies. This coverage may have certain limits and deductibles, so it's important to understand the details provided by your rideshare company.

4. Period 3: Passenger Onboard

When you have accepted a ride and have a passenger in your vehicle, the rideshare company's commercial liability coverage is usually in effect. This coverage provides protection for bodily injury and property damage caused to third parties in the event of an accident.

5. Rideshare Company Deductibles

In addition to understanding the coverage provided by the rideshare company, it's important to be aware of the deductibles that may apply. If you are involved in an accident during a covered period, you may be responsible for paying the deductible amount before the insurance coverage kicks in.

Car Insurance Requirements by Rideshare Companies

Each rideshare company has its own car insurance requirements that drivers must meet to be eligible to drive for their platform. It's essential to be familiar with these requirements and ensure you have the necessary coverage.

1. Liability Insurance

All rideshare companies require drivers to have liability insurance that meets certain minimum limits. Liability insurance covers bodily injury and property damage caused to third parties in an accident where the rideshare driver is at fault. The required limits may vary depending on the company and the state you are driving in.

2. Uninsured/Underinsured Motorist Coverage

Some rideshare companies also require drivers to have uninsured/underinsured motorist coverage. This coverage protects you if you are involved in an accident with a driver who does not have insurance or has insufficient coverage to pay for the damages.

3. Comprehensive and Collision Coverage

Rideshare companies generally do not require drivers to have comprehensive and collision coverage, which covers damage to your own vehicle in the event of an accident or other covered events. However, having this coverage is still recommended to protect your own vehicle.

4. Vehicle Age and Condition

Rideshare companies may have requirements regarding the age and condition of the vehicles used for rideshare driving. These requirements ensure that the vehicles are safe and in good working condition.

Additional Coverage Options

In addition to meeting the insurance requirements imposed by rideshare companies, there are additional coverage options you may consider to further protect yourself.

1. Rideshare Gap Insurance

Rideshare gap insurance can help fill the gaps in coverage during certain periods of rideshare driving when your personal auto insurance or the rideshare company's insurance may not provide sufficient protection. This coverage can be especially valuable if you have a high deductible or limited coverage during these periods.

2. Commercial Insurance

If you are a full-time rideshare driver or if you want more comprehensive coverage, you may consider purchasing a commercial insurance policy. Commercial insurance is specifically designed for businesses and can provide coverage for your rideshare activities, even during periods when you are not logged into the rideshare app.

Understanding Policy Limits

Policy limits refer to the maximum amount that an insurance company will pay for a covered claim. It is crucial to have a clear understanding of policy limits and ensure that your coverage is sufficient to protect you financially in case of an accident.

1. Bodily Injury Liability Limits

Bodily injury liability limits represent the maximum amount that your insurance company will pay for injuries caused to another person in an accident where you are at fault. It is important to have adequate bodily injury liability limits to protect your assets in case a lawsuit is filed against you.

2. Property Damage Liability Limits

Property damage liability limits represent the maximum amount that your insurance company will pay for damages caused to someone else's property in an accident where you are at fault. Similar to bodily injury liability limits, it is important to have sufficient property damage liability limits to avoid being personally responsible for damages that exceed your coverage.

3. Uninsured/Underinsured Motorist Limits

If you have chosen to have uninsured/underinsured motorist coverage, it is important to consider the limits for this coverage as well. This coverage protects you in case you are involved in an accident with a driver who does not have insurance or has insufficient coverage. Having adequate limits ensures that you are protected even in the event of a serious accident with significant damages.

Insurance Deductibles

An insurance deductible is the amount you are responsible for paying out of pocket before your insurance coverage kicks in. Understanding insurance deductibles is important as they can have an impact on your out-of-pocket expenses in case of an accident.

1. Personal Auto Insurance Deductibles

If you have a personal auto insurance policy with rideshare coverage, you may have a deductible for certain coverages. For example, if you have comprehensive and collision coverage, there will typically be a deductible for those coverages. It's important to know the amount of your deductibles and be prepared to pay them if you need to make a claim.

2. Rideshare Company Deductibles

In addition to personal auto insurance deductibles, there may be deductibles associated with the insurance provided by rideshare companies. If you are involved in an accident during a covered period, you may be responsible for paying the deductible amount before the insurance coverage kicks in. Understanding these deductibles helps you plan for potential expenses in case of an accident.

Insurance Considerations for Part-Time Rideshare Drivers

If you are a part-time rideshare driver, there are specific insurance considerations you should take into account to optimize your coverage.

1. Evaluating Your Personal Auto Insurance Policy

As a part-time rideshare driver, it's important to review your personal auto insurance policy to determine if it provides coverage for rideshare activities. Contact your insurance provider and inquire about rideshare endorsements or add-ons that can be added to your policy. These endorsements are specifically designed to fill the coverage gaps that may exist while driving for a rideshare company.

2. Understanding the Periods of Rideshare Driving

Part-time rideshare drivers should familiarize themselves with the different periods of rideshare driving and the corresponding insurance coverage. Knowing when you are covered by the rideshare company's insurance and when you need to rely on your personal auto insurance is crucial.

3. Rideshare Gap Insurance

Consider purchasing rideshare gap insurance to provide additional coverage during periods where your personal auto insurance does not apply. This can help protect you financially in case of an accident or other unforeseen events.

4. Cost-Benefit Analysis

When evaluating your insurance options as a part-time rideshare driver, it's important to conduct a cost-benefit analysis. Compare the cost of adding rideshare coverage to your personal auto insurance policy or purchasing a commercial policy against the potential risks and benefits. Find a balance that suits your needs and budget.

Insurance Considerations for Full-Time Rideshare Drivers

If you are a full-time rideshare driver, your insurance needs may differ from those of part-time drivers. Here are some considerations to keep in mind for comprehensive coverage:

1. Commercial Auto Insurance

Full-time rideshare drivers may benefit from purchasing a commercial auto insurance policy. Commercial insurance is designed for businesses and offers more comprehensive coverage that extends beyond the periods of rideshare driving.

2. Higher Liability Limits

Given the increased exposure and time spent on the road as a full-time rideshare driver, it's advisable to have higher liability limits. This ensures that you have adequate coverage in case of an accident resulting in significant injuries or property damage.

3. Comprehensive and Collision Coverage

Consider adding comprehensive and collision coverage to your insurance policy to protect your vehicle in the event of an accident or other covered events. This can help minimize out-of-pocket expenses when repairing or replacing your vehicle.

4. Reviewing Coverage Regularly

As a full-time rideshare driver, your insurance needs may change over time. It's important to review your coverage regularly to ensure it aligns with your current situation. This includes adjusting your policy limits, deductibles, and coverage options as necessary.

Tips for Choosing the Right Insurance Provider

Choosing the right insurance provider is crucial for rideshare drivers. Here are some tips to consider when selecting an insurance provider:

1. Research and Compare Quotes

Take the time to research and compare quotes from different insurance providers. Look for providers that offer rideshare endorsements or commercial auto insurance policies specifically tailored for rideshare drivers.

2. Financial Stability

Check the financial stability of the insurance provider. You want to ensure that they have the financial resources to pay out claims in case of an accident.

3. Customer Service and Claims Handling

Consider the reputation of the insurance provider for customer service and claims handling. Read reviews and testimonials to gauge their level of responsiveness and efficiency when it comes to addressing policyholders' needs.

4. Seek Recommendations

Ask other rideshare drivers for recommendations. They may have insights into the insurance providers that offer the best coverage and service for rideshare drivers. Their experiences can help guide your decision-making process.

5. Seek Professional Advice

If you're unsure about the insurance requirements or options available to you as a rideshare driver, consider consulting with an insurance agent or broker who specializes in rideshare insurance. They can provide personalized advice and help you navigate through the complexities of rideshare insurance.

In conclusion, understanding the insurance requirements for rideshare drivers is essential to ensure you are adequately protected in case of an accident or mishap. By familiarizing yourself with the information provided in this comprehensive guide, you can make informed decisions about your insurance coverage and drive with confidence. Remember, it is always better to be well-prepared and protected than to face potential financial and legal consequences.

Post a Comment for "Rideshare Driver Insurance Requirements: A Comprehensive Guide"