Indexed Universal Life Insurance Pros and Cons: A Comprehensive Guide

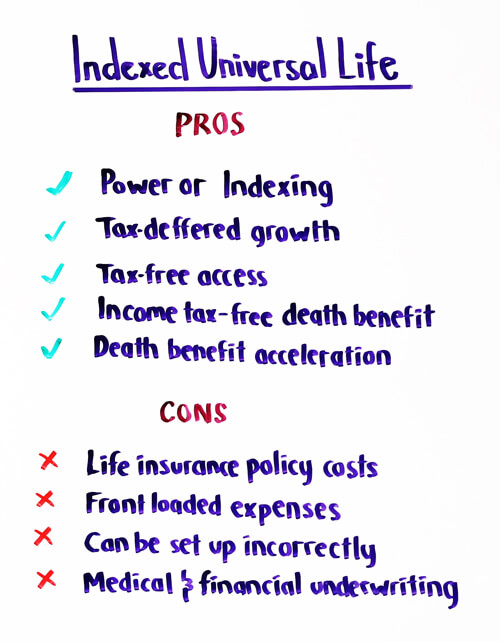

Indexed universal life insurance (IUL) is a type of permanent life insurance that offers both a death benefit and a cash value component. It has gained popularity in recent years due to its potential for higher returns compared to traditional universal life insurance policies. However, as with any financial product, IUL comes with its own set of pros and cons.

In this article, we will provide a detailed and comprehensive overview of the pros and cons of indexed universal life insurance. Whether you are considering purchasing this type of policy or simply want to learn more about it, this guide will help you make an informed decision.

Flexibility in Premium Payments

One of the major advantages of IUL is the flexibility it offers in premium payments. Unlike whole life insurance, which requires consistent premium payments throughout the life of the policy, IUL allows policyholders to adjust their premiums based on their financial situation.

This flexibility can be particularly beneficial for individuals who may experience changes in their income or financial obligations. For example, if you encounter a period of financial hardship, you can choose to pay a lower premium or even suspend premium payments for a certain period while still maintaining coverage.

On the other hand, during times of financial prosperity, you have the option to increase your premium payments, allowing for the potential accumulation of more cash value within the policy. This flexibility ensures that IUL can adapt to your changing financial circumstances.

Adjusting Premium Payments

One of the key features of IUL is the ability to adjust premium payments. Policyholders have the flexibility to increase or decrease their premium amounts based on their financial situation. This can be particularly advantageous for individuals who may experience fluctuating income or financial obligations.

If you find yourself facing financial difficulties, such as a job loss or unexpected expenses, you can choose to pay a lower premium or even suspend premium payments for a certain period. This can help alleviate financial strain while still maintaining the coverage and benefits provided by the policy.

Conversely, during times of financial stability or prosperity, you can increase your premium payments to accumulate more cash value within the policy. This can be especially beneficial for individuals who want to maximize the potential growth of their investment and build up a substantial cash value over time.

Potential for Cash Value Growth

Another key benefit of IUL is its potential for cash value growth. The cash value of an IUL policy is tied to a stock market index, such as the S&P 500, which means it has the potential to grow at a higher rate compared to traditional universal life insurance policies.

When the underlying stock market index performs well, the cash value of your IUL policy can increase significantly. This growth is often credited to the policy on an annual basis, allowing the cash value to compound over time. The ability to participate in market upswings can provide an opportunity for substantial cash value accumulation.

Furthermore, IUL policies typically come with a feature called a "cap rate" or "participation rate." These rates determine the maximum percentage of the index's gains that will be credited to the policy's cash value. While the cap rate limits the upside potential, it also provides a measure of protection during periods of market volatility.

Tied to Stock Market Index

An important aspect of IUL is that the cash value is tied to a stock market index. This means that the growth of the policy's cash value is linked to the performance of the chosen index, such as the S&P 500 or the Nasdaq.

When the stock market index performs well, the cash value of your IUL policy can experience significant growth. This growth is often based on a percentage of the index's gains, providing an opportunity for the cash value to accumulate at a higher rate compared to other types of permanent life insurance policies.

It's important to note that IUL policies typically have a cap rate or participation rate, which determines the maximum percentage of the index's gains that will be credited to the policy's cash value. The cap rate acts as a limit on the potential growth, ensuring that the policy is not overly exposed to market fluctuations and providing a measure of protection during periods of market volatility.

Cap Rate and Participation Rate

When considering an IUL policy, it's crucial to understand the cap rate and participation rate associated with the policy. These rates determine the maximum percentage of the index's gains that will be credited to the policy's cash value.

The cap rate sets a limit on the potential growth of the cash value, ensuring that policyholders do not solely rely on the performance of the underlying index. For example, if the cap rate is set at 10%, the policy's cash value will only be credited with up to 10% of the index's gains, even if the actual index performance exceeds this percentage.

On the other hand, the participation rate determines the percentage of the index's gains that will be credited to the policy's cash value. For instance, if the participation rate is set at 80%, the policy's cash value will receive 80% of the index's gains. If the index experiences a 10% increase, the cash value will grow by 8%.

It's important to carefully consider the cap rate and participation rate when selecting an IUL policy, as they can significantly impact the potential growth and overall performance of the policy's cash value.

Death Benefit Protection

IUL provides a death benefit that is paid out to the beneficiaries upon the policyholder's death. This death benefit can provide financial protection and support for loved ones, helping to cover funeral expenses, outstanding debts, and provide an inheritance.

The death benefit is a crucial aspect of life insurance, as it ensures that your loved ones are taken care of financially in the event of your passing. With IUL, the death benefit is typically tax-free and can be paid out either as a lump sum or in installments, depending on the preferences of the policyholder.

The amount of the death benefit is determined by various factors, including the policy's face amount, the age and health of the insured, and any additional riders or endorsements attached to the policy. It's important to regularly review your IUL policy to ensure that the death benefit adequately meets the needs of your beneficiaries.

Financial Protection for Beneficiaries

An essential aspect of IUL is the death benefit it provides to beneficiaries upon the policyholder's death. The death benefit is a lump sum payment that can help ease the financial burden on loved ones during a difficult time.

With an IUL policy, the death benefit is typically tax-free, meaning that beneficiaries receive the full amount of the policy's face value without any tax implications. This can provide significant financial protection and support for beneficiaries, helping to cover immediate expenses, such as funeral costs, outstanding debts, and daily living expenses.

In addition to the immediate financial support, the death benefit can also serve as a long-term financial resource. For example, if you have dependents or children, the death benefit can provide an inheritance that helps secure their financial future, such as funding education expenses or providing a financial safety net.

It's important to regularly review your IUL policy to ensure that the death benefit amount aligns with your current financial situation and the needs of your beneficiaries. Life changes, such as the birth of a child or changes in marital status, may warrant an adjustment in the death benefit to provide adequate financial protection for your loved ones.

Policy Loans and Withdrawals

One of the advantages of IUL is the ability to take out policy loans or make withdrawals from the cash value. This can be useful in times of financial need, such as paying for education expenses or unexpected medical bills.

When you need access to funds, an IUL policy allows you to borrow against the cash value of the policy. Policy loans typically have low-interest rates and don't require a credit check, making them an attractive option for individuals who may not qualify for traditional loans.

The borrowed amount is not subject to income tax, as it is considered a loan rather than taxable income. However, it's important to note that outstanding policy loans can reduce the death benefit if they are not repaid in full before the policyholder's death.

Policy Loans

One of the key features of IUL is the ability to take out policy loans against the cash value of the policy. Policy loans provide a convenient and flexible way to access funds when needed, without the need for a credit check or extensive paperwork.

When you take out a policy loan, you are essentially borrowing against the cash value that has accumulated within the policy. The loan amount is based on the available cash value, and the policy serves as collateral for the loan. The borrowed amount can be used for various purposes, such as covering education expenses, home improvements, or even starting a business.

One advantage of policy loans is that they typically have low-interest rates compared to other types of loans. The interest charged on the loan is usually credited back to the cash value, reducing the overall cost of borrowing. Additionally, the loan amount is not subject to income tax, as it is considered a loan rather than taxable income.

It's important to keep in mind that outstanding policy loans can have an impact on the policy's death benefit. If the loan is not repaid in full before the policyholder's death, the outstanding loan amount, plus anyaccrued interest, will be deducted from the death benefit. Therefore, it's essential to carefully manage policy loans and ensure timely repayment to maintain the intended level of financial protection for your beneficiaries.

Withdrawals

In addition to policy loans, IUL policies also allow for withdrawals from the cash value. Unlike loans, withdrawals are not required to be repaid, but they can impact the cash value and death benefit of the policy.

Withdrawals from the cash value are typically subject to certain limitations and may be subject to income tax if the amount withdrawn exceeds the total premiums paid into the policy. It's important to consult with a financial advisor or tax professional to understand the tax implications of withdrawals and ensure compliance with applicable regulations.

Withdrawals can be an attractive option for individuals who need access to funds but do not want to incur debt through policy loans. They provide a way to tap into the policy's cash value while maintaining the death benefit and potentially preserving the long-term growth potential of the policy.

Ultimately, whether you choose to take out a policy loan or make a withdrawal from the cash value, it's crucial to carefully consider the potential impact on the policy's cash value and death benefit. Balancing your immediate financial needs with your long-term goals is key to making informed decisions.

Potential for Higher Returns

Due to its tie to stock market indexes, IUL has the potential for higher returns compared to other types of permanent life insurance policies. This can be especially beneficial for individuals looking to accumulate wealth or save for retirement.

When the stock market index that the IUL policy is tied to performs well, the cash value of the policy can experience significant growth. This growth potential is often higher than what can be achieved with traditional universal life insurance policies or other lower-risk investment options.

It's important to note that while IUL offers the potential for higher returns, it also comes with some level of risk. The performance of the underlying stock market index can fluctuate, and there is the possibility of experiencing losses, especially during periods of market volatility.

However, IUL policies typically include a feature that protects against extreme market downturns. This feature, known as a "floor," ensures that the cash value does not decrease below a certain level, even if the index performs poorly. This downside protection provides a measure of security and helps mitigate the potential risks associated with market fluctuations.

Growth Potential in a Bull Market

One of the primary advantages of IUL is its potential for higher returns, especially during a bull market. When the stock market index that the policy is linked to experiences significant growth, the cash value of the policy can also increase substantially.

During a bull market, the cash value growth is often credited to the policy on an annual basis, allowing for compounding growth over time. This compounding effect can lead to substantial cash value accumulation and potentially outperform other types of life insurance policies or conservative investment options.

IUL policies typically have a cap rate or participation rate, which determines the maximum percentage of the index's gains that will be credited to the policy's cash value. While this cap rate limits the upside potential, it also provides a measure of protection during periods of extreme market growth.

Downside Protection in a Bear Market

While IUL offers the potential for higher returns, it also comes with the risk of market downturns. However, IUL policies often include a downside protection feature known as a "floor."

The floor ensures that the cash value of the policy does not decrease below a certain level, even if the underlying stock market index performs poorly. This means that during a bear market or period of market volatility, the cash value of the policy will not be directly impacted by the negative performance of the index.

This downside protection provides a level of security for policyholders, as it helps mitigate the potential risks associated with market fluctuations. It allows the cash value to maintain its stability and potentially recover when the market conditions improve.

It's important to note that the floor feature does not guarantee a positive return during periods of market decline. However, it does provide policyholders with some level of protection against extreme losses and helps preserve the policy's cash value over the long term.

Cost and Fees

One of the downsides of IUL is the cost and fees associated with the policy. IUL tends to have higher premiums compared to term life insurance and may include various fees, such as administrative fees and cost of insurance charges.

The cost of an IUL policy can vary depending on factors such as your age, health, and the desired death benefit amount. Since IUL policies offer both a death benefit and a cash value component, the premiums are typically higher compared to term life insurance policies, which provide only a death benefit.

In addition to premiums, there may be various fees associated with an IUL policy. These fees can include administrative fees, which cover the costs of policy administration and maintenance, as well as cost of insurance charges, which cover the mortality risk of the policyholder.

It's important to carefully review the fees associated with an IUL policy and consider how they may impact the overall cost of the policy. Comparing quotes from different insurance providers and understanding the fee structure can help you make an informed decision.

Premiums and Cost Comparison

When considering an IUL policy, it's important to understand the cost structure and how it compares to other types of life insurance. IUL policies typically have higher premiums compared to term life insurance policies, which provide coverage for a specific period (e.g., 10, 20, or 30 years).

The higher premiums of IUL policies are primarily due to the additional cash value component and the potential for higher returns. While term life insurance policies focus solely on providing a death benefit, IUL policies combine a death benefit with a savings or investment component, which increases the overall cost.

It's important to carefully evaluate your financial situation and goals to determine if the higher premiums associated with an IUL policy align with your needs. If you primarily seek death benefit protection and don't require the cash value component, a term life insurance policy may be a more cost-effective option.

Fees and Charges

In addition to premiums, IUL policies may include various fees and charges that can impact the overall cost of the policy. It's essential to carefully review the fee structure and understand how these fees are assessed.

Administrative fees are typically charged to cover the costs of policy administration and maintenance. These fees can vary between insurance providers and may be assessed on a monthly or annual basis. Understanding the administrative fees associated with an IUL policy is crucial in determining the ongoing cost of maintaining the policy.

Cost of insurance charges are another component of the fee structure for IUL policies. These charges cover the mortality risk of the policyholder and are typically higher for older individuals or those with underlying health conditions. Evaluating the cost of insurance charges is essential, as they directly impact the overall cost and affordability of the policy.

It's important to carefully review and compare the fees associated with different IUL policies from various insurance providers. Understanding the fee structure and how it aligns with your financial goals can help you make an informed decision and choose a policy that offers the best value for your needs.

Complexity of Policy Design

IUL policies can be complex and difficult to understand, especially for individuals with limited knowledge of insurance and investment products. It is essential to thoroughly review and understand the policy design and terms before purchasing an IUL policy.

The complexity of IUL policies stems from their combination of both life insurance and investment components. Understanding how the cash value accumulates, the impact of fees and charges, and the relationship between the policy and the underlying index requires a certain level of financial literacy.

Policy illustrations, which outline the potential growth of the cash value and death benefit over time, can be helpful in visualizing the long-term impact of different scenarios. However, it's important to remember that policy illustrations are based on assumptions and projections and may not accurately reflect the actual performance of the policy.

Consulting with a financial advisor or insurance professional who specializes in IUL policies can be invaluable in navigating the intricacies of the policy design. They can provide guidance, answer questions, and help you make an informed decision based on your unique financial situation and goals.

Understanding Policy Components

When considering an IUL policy, it's important to take the time to thoroughly understand the various components of the policy. This includes understanding how the cash value accumulates, the fees and charges associated with the policy, and the relationship between the policy and the underlying index.

The cash value accumulation in an IUL policy is tied to the performance of a stock market index, such as the S&P 500. Understanding how the index's performance affects the cash value growth and the potential risks associated with market fluctuations is crucial in evaluating the long-term benefits of the policy.

Fees and charges, such as administrative fees and cost of insurance charges, directly impact the overall cost of the policy and the growth potential of the cash value. It's important to carefully review and understand the fee structure to assess the financial impact of these charges on the policy's performance.

Finally, it's essential to grasp the relationship between the policy and the underlying index. This includes understanding the cap rate or participation rate, which determines the maximum percentage of the index's gains that will be credited tothe policy's cash value. Additionally, understanding the floor feature, which protects against extreme market downturns, provides insight into the policy's potential risk mitigation strategies.

To gain a comprehensive understanding of the policy design, it's recommended to review the policy contract and any associated documents provided by the insurance provider. These documents outline the terms and conditions of the policy, including the specific details regarding the cash value growth, fees, and charges.

While policy illustrations can be helpful in visualizing the potential growth of the cash value and death benefit, it's important to approach them with caution. Illustrations are based on certain assumptions and projections, and the actual performance of the policy may differ from what is depicted in the illustrations.

Seeking guidance from a financial advisor or insurance professional who specializes in IUL policies can provide valuable insights and assistance in navigating the complexities of the policy design. They can help clarify any questions or concerns you may have and ensure that you make an informed decision based on your unique financial goals and circumstances.

Market Volatility Risk

As IUL is tied to stock market indexes, there is a certain level of market volatility risk. If the stock market performs poorly, the cash value growth of the policy may be significantly affected.

Market volatility refers to the fluctuation in the value of stocks and other financial instruments in the market. It is driven by various factors, such as economic conditions, geopolitical events, and investor sentiment. These fluctuations can lead to periods of market downturns, where the stock market experiences declines in value.

During periods of market volatility or a bear market, the performance of the underlying index may be negative or lower than expected. As a result, the cash value growth of an IUL policy may be negatively impacted, potentially leading to lower returns or even a decrease in the cash value.

It's important to consider your risk tolerance and investment objectives when evaluating the market volatility risk associated with an IUL policy. While the potential for higher returns exists, it's essential to be prepared for fluctuations in the market and the potential impact on the cash value growth of the policy.

Impact of Market Downturns

Market downturns can have a significant impact on the cash value growth of an IUL policy. When the underlying stock market index experiences declines, the cash value may also decrease or grow at a slower rate than expected.

During periods of market volatility, it's important to remain focused on the long-term objectives of your IUL policy. The market has historically shown a tendency to rebound and recover from downturns over time. By maintaining a long-term perspective and staying committed to your investment strategy, you can potentially mitigate the impact of market downturns on the cash value growth of your IUL policy.

The floor feature included in many IUL policies provides a measure of protection against extreme market downturns. This feature ensures that the cash value does not decrease below a certain level, even if the underlying index performs poorly. While the floor does not guarantee a positive return during market declines, it helps preserve the stability of the cash value and provides some peace of mind during turbulent market conditions.

When evaluating the market volatility risk associated with an IUL policy, it's important to consider your risk tolerance and investment objectives. If you have a lower risk tolerance or are primarily seeking stability, an IUL policy may not be the most suitable option. On the other hand, if you have a higher risk tolerance and are comfortable with potential market fluctuations, an IUL policy can offer the opportunity for higher returns over the long term.

Surrender Charges

IUL policies may have surrender charges if the policy is canceled or surrendered within a specific period. These charges can significantly reduce the cash value of the policy if the policyholder decides to terminate the policy early.

Surrender charges are designed to discourage policyholders from canceling or surrendering their policies before a certain period, typically known as the surrender charge period. During this period, which is usually several years from the policy's inception, surrender charges apply if the policyholder chooses to terminate the policy.

The surrender charges are deducted from the cash value of the policy and can be significant, sometimes reaching a percentage of the premium or the cash value. The specific surrender charges and duration of the surrender charge period vary depending on the insurance provider and the policy's terms and conditions.

It's important to carefully consider the potential surrender charges associated with an IUL policy before making a decision. If there is a possibility that you may need to terminate the policy early, understanding the surrender charge structure and its financial impact is crucial in evaluating the overall cost and benefits of the policy.

Duration and Impact of Surrender Charges

The surrender charge period and the associated surrender charges can vary between insurance providers and policies. It's important to review the policy contract and any accompanying documents to understand the specific terms and conditions.

The surrender charge period typically ranges from five to fifteen years, although it can be longer or shorter depending on the policy. During this period, surrender charges apply if the policy is canceled or surrendered.

The surrender charges are calculated based on a percentage of the premium or the cash value and are deducted from the cash value of the policy. This means that if you decide to terminate the policy early, you may receive less than the total cash value accumulated within the policy due to the surrender charges.

It's crucial to carefully evaluate your financial situation and long-term commitment to an IUL policy before purchasing. Understanding the potential impact of surrender charges and considering how they align with your financial goals can help you make an informed decision.

Limited Investment Options

While IUL offers the potential for higher returns, it typically limits the investment options to a few stock market indexes. This lack of investment diversification may not be suitable for individuals looking for a broader range of investment opportunities.

IUL policies are linked to specific stock market indexes, such as the S&P 500 or the Nasdaq. This means that the cash value growth of the policy is directly tied to the performance of the chosen index.

While the potential for higher returns exists within the chosen index, the lack of investment diversification can expose the policyholder to concentration risk. If the chosen index performs poorly, the cash value growth of the policy may be significantly impacted.

Individuals with a higher risk tolerance or those seeking a more diverse investment portfolio may find that the limited investment options of an IUL policy do not align with their investment objectives. In such cases, exploring other investment options, such as mutual funds or exchange-traded funds (ETFs), may be more suitable.

Benefits of Diversification

Diversification is a widely recognized investment strategy that aims to reduce risk by spreading investments across different asset classes and sectors. By diversifying your investments, you can potentially minimize the impact of poor performance in a single investment.

While IUL policies provide the potential for higher returns tied to a specific stock market index, they lack the diversification benefits offered by a well-rounded investment portfolio. Investing solely in a single index exposes the policyholder to concentration risk, as the performance of the chosen index directly impacts the cash value growth of the policy.

Individuals seeking a more diverse investment portfolio or those with a higher risk tolerance may find it more suitable to explore other investment options alongside or instead of an IUL policy. These options can include mutual funds, ETFs, or other investment vehicles that offer a broader range of investment opportunities.

By diversifying your investments, you can potentially mitigate the impact of poor performance in a single investment and build a more balanced portfolio that aligns with your risk tolerance and investment objectives.

Conclusion

Indexed universal life insurance (IUL) offers a range of advantages and disadvantages that must be carefully considered before making a decision. The flexibility in premium payments allows policyholders to adjust their premiums based on their financial situation, providing a level of adaptability not found in other types of permanent life insurance policies.

The potential for cash value growth, tied to stock market indexes, presents an opportunity for higher returns and the accumulation of wealth over time. However, market volatility risk must be taken into account, as the performance of the underlying index can significantly impact the cash value growth of the policy.

IUL also provides a death benefit that offers financial protection and support for beneficiaries. Policy loans and withdrawals allow for access to funds in times of financial need, although careful consideration must be given to the impact on the policy's cash value and death benefit.

Despite its advantages, IUL comes with certain drawbacks. The cost and fees associated with IUL policies can be higher compared to term life insurance, and the complexity of the policy design requires careful understanding and evaluation.

Finally, surrender charges and limited investment options are important considerations that can impact the overall cost and suitability of an IUL policy. Understanding these pros and cons is crucial in making an informed decision regarding indexed universal life insurance.

Ultimately, the decision to purchase an IUL policy should be based on a thorough evaluation of your financial goals, risk tolerance, and long-term commitment. Consulting with a financial advisor or insurance professional can provide valuable guidance and help ensure that you select a policy that aligns with your unique needs and circumstances.

Post a Comment for "Indexed Universal Life Insurance Pros and Cons: A Comprehensive Guide"