Workers' Compensation Insurance Rates by State: A Comprehensive Guide

Workers' compensation insurance is a critical component for businesses to protect their employees and ensure their financial stability in case of work-related injuries or illnesses. However, the rates for this insurance can vary significantly from state to state, making it crucial for employers to understand the factors that influence these rates in their respective locations.

In this comprehensive guide, we will delve into the intricacies of workers' compensation insurance rates by state, providing you with a detailed and comprehensive overview of the key factors that impact these rates and how they differ across the United States. Whether you are a business owner, insurance professional, or simply interested in understanding the dynamics of workers' compensation insurance, this article will serve as a valuable resource.

Understanding Workers' Compensation Insurance

Workers' compensation insurance is a type of coverage that provides wage replacement and medical benefits to employees who suffer work-related injuries or illnesses. It is a no-fault system, meaning that employees are entitled to receive benefits regardless of who is at fault for the accident or incident.

The purpose of workers' compensation insurance is twofold. First, it aims to provide financial protection for injured or ill workers by covering their medical expenses, rehabilitation costs, and a portion of their lost wages. Second, it protects employers from potential lawsuits by providing an exclusive remedy for injured employees, preventing them from suing their employer for negligence in most cases.

The Legal Framework of Workers' Compensation Insurance

In the United States, workers' compensation insurance is primarily regulated at the state level. Each state has its own laws and regulations that govern workers' compensation, resulting in variations in coverage, benefits, and rates across the country.

Most states require employers to carry workers' compensation insurance, although the specific requirements can vary. Some states require all employers to provide coverage, while others have exemptions based on factors such as company size or the type of work performed.

The Role of Insurance Carriers and Rating Bureaus

Insurance carriers play a crucial role in the workers' compensation system. They provide the insurance coverage to employers and handle the claims process when an employee gets injured or falls ill. Insurance carriers also determine the rates charged to employers based on various factors.

In many states, insurance carriers rely on rating bureaus to assist in establishing rates. These rating bureaus collect data on workplace injuries, claims, and other relevant information from insurers and use this data to develop rating plans and determine appropriate rates for different industries and occupations.

Benefits of Workers' Compensation Insurance for Employers and Employees

Workers' compensation insurance offers several benefits for both employers and employees. For employers, having workers' compensation coverage protects them from potential lawsuits and the financial burden of paying for medical expenses and lost wages out-of-pocket. It also fosters a safer work environment by incentivizing employers to maintain and improve workplace safety standards.

For employees, workers' compensation insurance provides crucial financial protection in case of a work-related injury or illness. It ensures that they receive timely medical treatment, rehabilitation services, and compensation for lost wages, allowing them to focus on recovery and get back to work as soon as possible.

Factors Affecting Workers' Compensation Rates

There are several factors that influence workers' compensation insurance rates. Understanding these factors is essential for employers to determine the cost of coverage and make informed decisions to manage their workers' compensation expenses effectively.

Industry Type and Occupational Risk

The industry in which a business operates plays a significant role in determining workers' compensation rates. Some industries, such as construction or manufacturing, have inherently higher risks of workplace injuries due to the nature of the work involved. Jobs that require heavy physical labor or involve working with hazardous materials are typically associated with higher rates.

Insurance carriers assess the occupational risk associated with different industries and occupations to determine appropriate rates. They consider factors such as injury frequency and severity, historical claims data, and the availability of safety measures and training programs within the industry.

Company Size and Payroll

The size of a company and its total payroll also impact workers' compensation rates. Generally, larger companies with higher payrolls tend to have higher rates compared to smaller businesses. This is because larger companies typically have more employees and, therefore, a higher likelihood of workplace injuries or illnesses.

Insurance carriers consider the size of a company and its payroll when determining rates because they use payroll as a basis for calculating premiums. A company with a larger payroll will have a higher premium since the potential exposure to claims is greater.

Claims History and Experience Modification Factor

The claims history of a company plays a significant role in determining its workers' compensation rates. Insurance carriers examine the frequency and severity of past claims when calculating rates. Companies with a history of frequent and severe claims can expect higher rates as they are considered more likely to have future claims.

The experience modification factor (EMR), also known as the mod factor, is a crucial component in determining workers' compensation rates. It is a numeric representation of a company's claims history and safety performance compared to other businesses in the same industry. A higher EMR indicates a higher risk profile and leads to higher rates, while a lower EMR may result in lower rates.

Safety Initiatives and Risk Management Programs

Companies that prioritize workplace safety and implement comprehensive risk management programs can potentially lower their workers' compensation rates. Insurance carriers take into account the safety initiatives and risk management practices of a business when determining rates.

Implementing safety programs, conducting regular employee training, and maintaining a proactive approach to identifying and mitigating workplace hazards can demonstrate a commitment to reducing the frequency and severity of workplace injuries. This, in turn, can lead to lower rates as insurance carriers view such companies as less risky to insure.

Location and State Regulations

Workers' compensation rates can also vary significantly based on the location of a business. Each state has its own workers' compensation laws and regulations that govern coverage, benefits, and rates. These state-specific factors can influence the overall cost of workers' compensation insurance.

Some states have more favorable regulatory environments for businesses, resulting in lower rates, while others may have stricter regulations or higher benefit requirements, leading to higher rates. Factors such as the legal framework, administrative costs, medical fee schedules, and reimbursement rates can all impact the rates charged by insurance carriers.

State-by-State Comparison of Workers' Compensation Rates

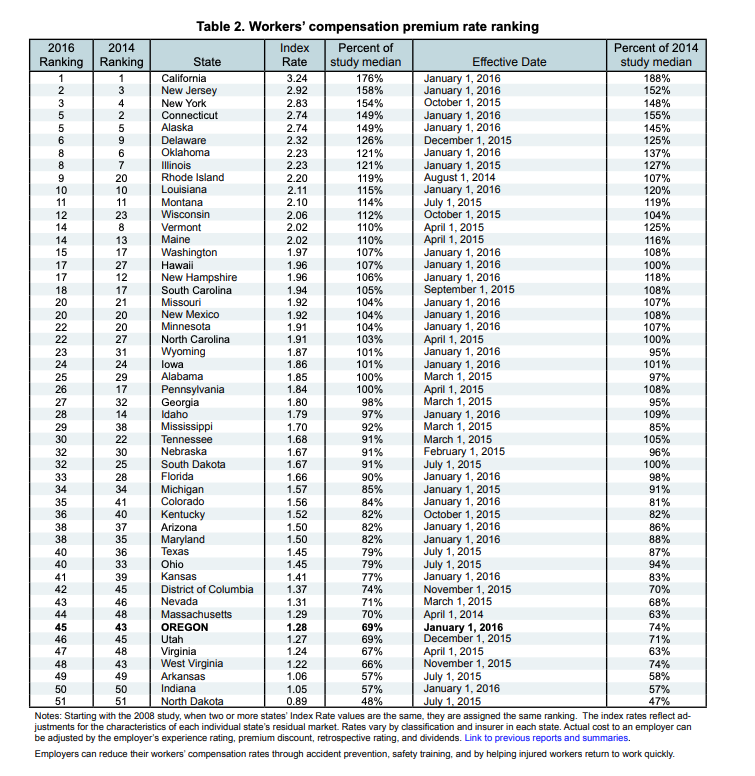

Understanding the workers' compensation rates in each state is crucial for employers operating across multiple locations or considering expanding their operations to a new state. Rates can vary significantly, and being aware of these differences can help businesses plan their budget and make informed decisions.

Average Rates by State

When comparing workers' compensation rates across states, it is essential to look at the average rates for each jurisdiction. Average rates provide a benchmark for understanding the overall cost of coverage in a particular state. These rates are typically expressed as a rate per $100 of payroll.

For example, as of 2021, California has one of the highest average rates in the country, with an average rate of $2.32 per $100 of payroll. On the other hand, states like North Dakota and Indiana have lower average rates, with $0.88 and $1.04 per $100 of payroll, respectively.

Minimum and Maximum Rates

Understanding the range of workers' compensation rates within a state is equally important. States typically set minimum and maximum rates that insurance carriers can charge employers, providing some regulatory control over the pricing of workers' compensation insurance.

For instance, in Florida, the minimum rate as of 2021 is $0.20 per $100 of payroll, while the maximum rate is $2.57 per $100 of payroll. These ranges can vary significantly from state to state, reflecting the different factors and regulations that influence rates.

Unique Regulations and Laws

Each state has its unique regulations and laws that govern workers' compensation insurance. These regulations can impact the rates charged by insurance carriers and the benefits provided to injured employees.

For example, some states have specific regulations regarding the choice of medical providers or the utilization of treatment guidelines, which can impact the overall cost of medical expenses and, subsequently, the rates. Other states may have different rules for determining the level of disability benefits or the duration of benefits for certain injuries or illnesses.

Competitive Markets and State Funds

Some states have competitive workers' compensation insurance markets, which can result in lower rates due to increased competition among insurance carriers. In these states, multiple insurance carriers operate, providing employers with choices and potentially more favorable pricing.

On the other hand, certain states have state-operated funds or monopolistic state funds where employers must obtain coverage exclusively from the state fund. These funds can have unique pricing structures and regulations, often varying from the standard insurance market.

Impact of State-Specific Factors

State-specific factors can significantly impact workers' compensation rates. For instance, states with a higher cost of living or higher healthcare costs may have higher rates to account for these factors. Additionally, states with ahigher incidence of workplace injuries or a higher percentage of high-risk industries may have higher rates compared to states with lower rates of injuries or predominantly low-risk industries.

Furthermore, state-specific regulations and laws can also impact rates. For example, some states have stricter regulations regarding the calculation of benefits or the determination of disability ratings, which can affect the overall cost of coverage. Additionally, the availability and accessibility of medical providers and treatment options in a state can also influence rates, as it can impact the cost of medical expenses.

It is important for employers to be aware of these state-specific factors when considering workers' compensation insurance rates. This knowledge can help businesses plan their budgets, evaluate the potential costs of expanding into new states, and understand the competitive landscape within each jurisdiction.

Trends and Changes in Workers' Compensation Rates

Workers' compensation rates are not static and can change over time. Various factors contribute to these changes, including shifts in the economy, legislative reforms, and emerging industry trends. It is crucial for employers and insurance professionals to stay informed about these trends and changes to effectively manage their workers' compensation costs and make informed decisions.

Economic Factors

The overall state of the economy can impact workers' compensation rates. During periods of economic growth and low unemployment rates, there is often an increase in workplace activity, leading to a higher frequency of injuries and, subsequently, higher rates. Conversely, during economic downturns or recessions, there may be a decrease in workplace activity and a corresponding decrease in injury frequency, potentially resulting in lower rates.

Legislative Reforms

Legislative reforms aimed at improving the workers' compensation system can also impact rates. These reforms can include changes to benefit structures, modifications to the calculation of disability ratings, or alterations to the legal framework governing workers' compensation. Reforms that aim to reduce costs or streamline the claims process may result in lower rates, while reforms that increase benefit levels or expand coverage may lead to higher rates.

Emerging Industry Trends

Emerging industry trends can also influence workers' compensation rates. As new technologies and industries emerge, the risks associated with certain occupations may change, which can impact rates. For example, the rise of telecommuting and remote work arrangements has led to new considerations in determining workers' compensation rates, as the risk of workplace injuries may differ for remote workers compared to those in traditional office settings.

Additionally, changes in workplace practices and safety protocols can also influence rates. As industries adopt new safety measures, invest in training programs, or implement advanced technologies to reduce the risk of injuries, it can potentially lead to lower rates. Insurance carriers take these industry-specific trends into account when assessing the risk profiles of businesses and determining appropriate rates.

Impact of Catastrophic Events

Catastrophic events, such as natural disasters or large-scale accidents, can have a significant impact on workers' compensation rates. These events often result in a sudden increase in claims, leading to higher costs for insurance carriers. In response, carriers may adjust rates to account for the increased risk and potential financial exposure. For example, regions prone to hurricanes or earthquakes may have higher rates compared to areas with lower risk levels.

Technological Advancements and Data Analytics

The advancement of technology and data analytics has enabled insurance carriers to refine their underwriting processes and better assess risks. By analyzing large volumes of data, carriers can identify patterns, trends, and correlations that help them more accurately predict the likelihood of workplace injuries and determine appropriate rates. This increased precision in risk assessment can lead to more customized rates for businesses, reflecting their specific risk profiles.

Impact of COVID-19 on Workers' Compensation Rates

The COVID-19 pandemic has had a profound impact on various aspects of society, including workers' compensation. The pandemic has led to an increase in claims related to occupational exposure to the virus, resulting in additional costs for insurance carriers. As a result, some carriers may adjust rates to account for the increased risk and potential long-term implications of COVID-19 on the workers' compensation system.

Additionally, the pandemic has also highlighted the importance of workplace safety and the need for businesses to implement robust safety protocols to protect their employees. Insurance carriers may consider the safety measures implemented by businesses when determining rates, potentially rewarding those with strong safety programs and practices with lower rates.

Strategies to Manage Workers' Compensation Costs

Managing workers' compensation costs is a priority for businesses of all sizes. By implementing effective strategies and best practices, employers can minimize the frequency and severity of workplace injuries, control insurance premiums, and improve the overall safety of their workforce. Here are some key strategies to consider:

1. Prioritize Workplace Safety and Risk Management

The foundation of any effective workers' compensation cost management strategy is prioritizing workplace safety and implementing robust risk management programs. By creating a culture of safety and providing ongoing safety training, employers can reduce the likelihood of workplace injuries and illnesses. Regular safety audits, hazard assessments, and proactive identification and mitigation of potential risks can further enhance workplace safety.

Employers should also establish clear safety policies and procedures, ensuring that employees are aware of and adhere to them. Regular communication and training sessions can help reinforce these policies and keep safety top-of-mind for all employees.

2. Implement Return-to-Work Programs

Return-to-work programs are designed to facilitate the smooth transition of injured employees back into the workforce. These programs offer modified duty or transitional work assignments that accommodate the employee's capabilities while they recover. By providing meaningful work and maintaining employee engagement, return-to-work programs can help reduce the duration of disability claims and associated costs.

Employers can collaborate with medical professionals, insurers, and employees to develop customized return-to-work plans that consider the employee's medical restrictions and capabilities. These plans should focus on gradually increasing work responsibilities as the employee recovers, while ensuring their safety and well-being.

3. Engage Employees in Safety Initiatives

Employees play a crucial role in creating a safe work environment. Employers should actively involve employees in safety initiatives by encouraging them to report hazards, participate in safety training programs, and provide feedback on safety protocols. This engagement fosters a sense of ownership and responsibility for workplace safety, increasing the likelihood of compliance with safety policies and procedures.

Regular safety meetings, toolbox talks, and safety committees can provide platforms for open communication and collaboration between employers and employees. Employers should also recognize and reward employees who demonstrate exemplary safety practices or contribute to improving workplace safety.

4. Partner with Insurance Professionals

Working closely with insurance professionals, such as brokers or agents specializing in workers' compensation insurance, can provide valuable guidance and expertise in managing insurance costs. These professionals can help businesses navigate the complexities of workers' compensation, analyze their risk profiles, and identify opportunities for cost savings.

Insurance professionals can assist in evaluating insurance carriers, negotiating policy terms, and identifying potential discounts or credits that may be available. They can also provide insights on industry-specific best practices and help businesses stay updated on regulatory changes that may impact workers' compensation rates.

5. Establish a Return-to-Work Culture

Creating a return-to-work culture within the organization is essential for managing workers' compensation costs. This involves promoting the mindset that returning to work, even in a modified capacity, is beneficial for the injured employee's overall well-being and recovery.

Employers should communicate the benefits of return-to-work programs to employees, emphasizing that these programs support their physical and financial well-being. By fostering a supportive and inclusive environment, employers can encourage employees to actively participate in the return-to-work process and reduce the potential for prolonged disability claims.

6. Monitor and Manage Claims Effectively

Proactive claims management is crucial for controlling workers' compensation costs. Employers should establish processes to promptly report and investigate workplace injuries, ensuring that all necessary documentation is completed accurately and submitted to the insurance carrier in a timely manner.

Monitoring and tracking claims throughout the entire process allows employers to identify any potential issues early on and take appropriate action. Regular communication with the injured employee, the insurance carrier, and medical providers can help facilitate a smooth claims process and ensure that appropriate medical treatment and rehabilitation services are provided.

7. Review and Audit Insurance Premiums

Regularly reviewing and auditing insurance premiums can help identify any discrepancies or errors that may be inflating costs. Employers should carefully examine their policy terms, classifications, and payroll data to ensure accuracy and consistency with their operations.

Consulting with insurance professionals or independent auditors specializing in workers' compensation can provide an objective assessment of the premium calculations and identify potential areas for cost savings. Employers should also be proactive in addressing any concerns or discrepancies with the insurance carrier to ensure accurate premium calculations.

8. Invest in Employee Wellness Programs

Employee wellness programs can contribute to reducing workplace injuries and improving overall employee health and well-being. These programs can include initiatives such as ergonomic assessments, stress management workshops, fitness programs, and health screenings.

By promoting a healthy lifestyle and providing resources to support physical and mental well-being, employers can help reduce the risk of injuries and illnesses, leading to potential cost savings in workers'compensation insurance. Wellness programs can also contribute to a positive work culture and employee engagement, leading to increased productivity and reduced absenteeism.

Industry-Specific Workers' Compensation Rates

While we have explored the general factors affecting workers' compensation rates, it is important to recognize that certain industries may have unique considerations that impact their rates. Specific industries may have higher or lower risks of workplace injuries or illnesses, and insurance carriers take these industry-specific factors into account when determining rates. Here are some examples:

Construction Industry

The construction industry is known for its high-risk nature, with workers frequently exposed to hazards such as falls, heavy equipment, and hazardous materials. As a result, workers' compensation rates for construction companies tend to be higher compared to other industries. Insurance carriers consider factors such as the type of construction work performed (e.g., residential, commercial, or industrial), the size of the construction company, and the safety protocols in place when determining rates for this industry.

Healthcare Industry

The healthcare industry also faces unique risks due to the nature of the work involved. Healthcare workers, such as nurses and caregivers, are exposed to potential injuries from patient handling, needlestick injuries, and workplace violence. Additionally, the healthcare industry has its own set of occupational hazards, such as exposure to infectious diseases. These factors contribute to higher workers' compensation rates for healthcare facilities and providers.

Manufacturing Industry

The manufacturing industry encompasses a wide range of activities, from food processing to automotive production. Depending on the specific manufacturing processes and equipment used, certain sub-industries within manufacturing may have higher risks of workplace injuries, such as exposure to machinery, chemicals, or repetitive motion. Insurance carriers consider these factors when determining rates for manufacturing companies, with higher-risk sub-industries often facing higher rates.

Transportation and Trucking Industry

The transportation and trucking industry presents unique challenges and risks, as workers in this industry often operate heavy vehicles and face long hours on the road. The risk of accidents, injuries from loading and unloading cargo, and musculoskeletal injuries from prolonged sitting or heavy lifting are factors that contribute to higher workers' compensation rates for this industry. Insurance carriers also consider the size and type of vehicles used, as well as the safety records and training programs of transportation companies when determining rates.

Professional Services and Office-Based Work

Professional services and office-based work typically have lower risks of workplace injuries compared to industries involving physical labor or hazardous conditions. Workers in these industries are less likely to experience severe injuries, and their workers' compensation rates tend to be lower. However, it is still important for employers in these industries to prioritize workplace safety and implement appropriate risk management programs to maintain low rates and ensure the well-being of their employees.

State-Specific Industries

Some states have industries that are particularly influential in their economy and have unique considerations when it comes to workers' compensation rates. For example, states with a significant agricultural sector may have specific rates and regulations tailored to the needs of agricultural businesses. Similarly, states with a strong maritime industry may have specialized workers' compensation rates for workers in the maritime sector. These state-specific industries may have additional requirements or regulations that impact workers' compensation rates within those sectors.

International Comparisons

While this guide primarily focuses on workers' compensation rates within the United States, it is worth noting that workers' compensation systems and rates vary across countries. Different countries have their own unique legal frameworks, benefit structures, and rating systems. Employers with international operations or those considering expanding globally should be aware of the specific workers' compensation requirements and rates in each country to ensure compliance and manage costs effectively.

Workers' Compensation Insurance Fraud

Unfortunately, workers' compensation insurance fraud is a prevalent issue that affects rates and the overall integrity of the system. Fraudulent claims can result in increased costs for insurance carriers, leading to higher rates for employers. It is important to understand the types of workers' compensation insurance fraud and the measures taken to combat it.

Types of Workers' Compensation Insurance Fraud

Workers' compensation insurance fraud can occur in various forms, including:

1. Employee Fraud

Employee fraud occurs when an employee intentionally exaggerates or fabricates an injury to receive benefits they are not entitled to. This can involve misrepresenting the severity of an injury, feigning a work-related injury that did not occur, or continuing to claim benefits after recovering from an injury.

2. Employer Fraud

Employer fraud involves employers misrepresenting information to obtain lower workers' compensation insurance rates. This can include underreporting payroll, misclassifying employees to pay lower premiums, or failing to provide coverage for eligible employees.

3. Provider Fraud

Provider fraud occurs when healthcare providers or medical professionals bill for unnecessary treatments or services related to workers' compensation claims. This can involve submitting false claims, overcharging for services, or providing unnecessary medical treatments.

Consequences of Workers' Compensation Insurance Fraud

Workers' compensation insurance fraud has significant consequences for all parties involved. When fraudulent claims occur, insurance carriers may incur additional costs, resulting in higher rates for employers. Legitimate claimants may also suffer as resources are diverted to address fraudulent claims instead of providing appropriate benefits and support.

Fraudulent activities undermine the integrity of the workers' compensation system, making it more challenging to identify and address legitimate claims. It erodes trust among employers, employees, and insurance carriers, leading to increased skepticism and scrutiny of all claims.

Measures to Combat Workers' Compensation Insurance Fraud

To combat workers' compensation insurance fraud, various measures are in place, including:

1. Fraud Detection and Investigation

Insurance carriers have dedicated fraud investigation units that employ specialized techniques to identify potentially fraudulent claims. They use data analysis, surveillance, and collaboration with law enforcement agencies to uncover fraudulent activities. The investigation process may involve reviewing medical records, interviewing claimants and witnesses, and conducting background checks.

2. Education and Awareness

Education and awareness campaigns are essential in preventing workers' compensation insurance fraud. Employers, employees, and medical providers should be educated about the consequences of fraudulent activities and the importance of maintaining the integrity of the workers' compensation system. Training programs can help employees understand their rights and responsibilities while ensuring that employers are aware of their obligations under workers' compensation laws.

3. Collaboration and Data Sharing

Insurance carriers, industry associations, and law enforcement agencies collaborate to share information and coordinate efforts to combat fraud. Sharing data and insights allows for a more comprehensive understanding of fraudulent patterns and trends, leading to more effective prevention and detection measures.

4. Enhanced Legislative and Regulatory Measures

Legislative and regulatory reforms are constantly being implemented to strengthen the workers' compensation system and address fraud. These reforms may include stricter penalties for fraudulent activities, enhanced monitoring and reporting requirements, and increased resources for fraud investigation units.

5. Technology and Data Analytics

The advancement of technology and data analytics has provided insurance carriers with powerful tools to identify and prevent workers' compensation insurance fraud. Predictive modeling, artificial intelligence, and machine learning algorithms can analyze vast amounts of data to identify suspicious claims and patterns that may indicate fraudulent activities. These technological advancements allow for more efficient and accurate fraud detection, reducing costs and protecting the integrity of the workers' compensation system.

Impact of COVID-19 on Workers' Compensation Rates

The COVID-19 pandemic has had a far-reaching impact on various aspects of society, including workers' compensation rates. The emergence of the novel coronavirus and its spread across the globe have presented unique challenges and considerations for the workers' compensation system. Here are some key factors related to COVID-19 that have influenced workers' compensation rates:

Occupational Exposure and Transmission

COVID-19 is a highly contagious virus, and certain occupations have a higher risk of occupational exposure and transmission. Frontline healthcare workers, first responders, and essential workers in industries such as retail, transportation, and food services face a heightened risk of contracting the virus due to their close proximity to the public or working in high-risk environments. The increased likelihood of workplace transmission has led to an increase in workers' compensation claims related to COVID-19.

Compensability of COVID-19 Claims

The compensability of COVID-19 claims has been a topic of discussion and debate. In some jurisdictions, legislation has been enacted to provide a presumption that certain categories of workers who contract COVID-19 did so as a result of their employment, making it easier for these workers to establish a compensable claim. This presumption can impact the frequency and costs of workers' compensation claims related to COVID-19, potentially leading to higher rates.

Medical Treatment and Rehabilitation Costs

Workers' compensation insurance covers medical treatment and rehabilitation costs for work-related injuries and illnesses, including those related to COVID-19. The medical treatment and rehabilitation costs associated with COVID-19 can vary depending on the severity of the illness and the required medical interventions. The influx of COVID-19-related claims has put additional strain on the healthcare system, leading to potential increases in medical costs and, in turn, influencing workers' compensation rates.

Long-Term Implications and Complications

COVID-19 has been associated with long-term health complications for some individuals, even after recovering from the acute illness. Conditions such as long COVID or post-acute sequelae of SARS-CoV-2 infection (PASC) can result in ongoing medical treatment and potential long-term disability. The long-term implications and complications of COVID-19 can impact the duration and costs of workers' compensation claims, potentially influencing rates over time.

Legislative Reforms and Emergency Orders

In response to the COVID-19 pandemic, many states have implemented legislative reforms and emergency orders to address workers' compensation coverage for COVID-19-related claims. These reforms may impact the compensability of claims, establish specific guidelines for COVID-19 testing and treatment, or provide financial support for frontline workers. These changes in legislation and regulations can have implications for workers' compensation rates, as they may affect the costs and requirements associated with COVID-19 claims.

Changes in Workforce and Work Practices

The COVID-19 pandemic has also led to significant shifts in the workforce and work practices. Many businesses have adopted remote work arrangements or implemented new safety protocols to mitigate the risk of COVID-19 transmission. These changes in work practices can impact workers' compensation rates by altering the risk profiles of businesses. For example, remote work may reduce the risk of workplace injuries and result in lower rates for certain industries, while industries that require in-person work may experience different rate dynamics due to the specific safety measures implemented.

Insurance Carrier Responses

Insurance carriers have been closely monitoring the impact of COVID-19 on workers' compensation rates and adjusting their underwriting and pricing strategies accordingly. The increased number of COVID-19 claims, potential long-term complications, and evolving legislative landscape have prompted carriers to reassess their risk assumptions and pricing models. This may result in adjustments to rates to reflect the changing risk landscape associated with the pandemic.

Long-Term Outlook and Uncertainties

As the COVID-19 pandemic continues to evolve, the long-term outlook for workers' compensation rates remains uncertain. Factors such as the progress of vaccination efforts, the emergence of new variants, and the duration of the pandemic will continue to shape the trajectory of workers' compensation rates. Monitoring and understanding these variables will be crucial for employers, insurance professionals, and regulators to effectively manage workers' compensation costs and ensure the continued protection of workers.

Legal Considerations and Compliance

Complying with workers' compensation laws and regulations is essential for employers to protect their employees, meet legal obligations, and avoid potential penalties. Understanding the legal considerations and compliance requirements surrounding workers' compensation insurance helps employers navigate the complexities of the system and ensure they are in compliance with applicable laws.

Mandatory Coverage Requirements

Most states have mandatory workers' compensation coverage requirements for employers. The specific requirements vary by state, but typically, employers must provide workers' compensation insurance if they have a certain number of employees. This threshold can differ based on factors such as the type of industry, the nature of work performed, and the state in which the business operates.

It is important for employers to determine whether they are subject to mandatory coverage requirements and to obtain the appropriate workers' compensation insurance policy to ensure compliance. Failure to provide mandatory coverage can result in penalties, fines, and potential legal liability for employers.

Classification of Employees

The proper classification of employees is crucial for determining workers' compensation insurance rates and coverage. Insurance carriers use classification codes to assign appropriate rates based on the level of risk associated with different types of work. Employers must accurately classify their employees based on their job duties and the industry in which they operate.

Misclassifying employees can result in inaccurate premium calculations, potentially leading to underpayment or overpayment of premiums. Misclassification may also result in gaps in coverage, leaving employees without the necessary protection in case of a work-related injury or illness. Employers should consult industry-specific guidelines and seek guidance from insurance professionals to ensure proper employee classification.

Recordkeeping and Reporting

Employers are typically required to maintain accurate records related to workers' compensation, including injury reports, medical records, and claim documentation. These records are important for substantiating claims, tracking injuries and illnesses, and demonstrating compliance with reporting requirements. Employers should establish processes and systems to effectively record and retain these documents in accordance with applicable laws and regulations.

Additionally, employers must comply with reporting requirements for workplace injuries or illnesses. This typically involves reporting incidents to the appropriate state agency and, in some cases, notifying the insurance carrier within a specified timeframe. Failure to comply with reporting requirements can result in penalties and potential delays in claim processing.

Employee Rights and Benefits

Workers' compensation laws include provisions to protect the rights of employees. Employees have the right to seek medical treatment for work-related injuries and illnesses, report workplace incidents to their employers, and file workers' compensation claims. Employers must respect these rights and provide the necessary support and resources to employees throughout the claims process.

Employees may be entitled to various benefits under workers' compensation, including medical treatment, wage replacement, vocational rehabilitation, and disability benefits. Employers should ensure that employees are aware of their rights and benefits under the workers' compensation system and provide the necessary information and assistance to facilitate their claims.

State-Specific Regulations and Variations

It is important to note that workers' compensation laws and regulations can vary significantly from state to state. Each state has its own legal framework, administrative processes, and benefit structures. These variations can impact coverage requirements, benefit levels, dispute resolution mechanisms, and other aspects of workers' compensation.

Employers operating in multiple states or considering expansion into new jurisdictions must familiarize themselves with the specific workers' compensation laws and regulations in each state. This may involve consulting legal counsel or insurance professionals with expertise in the respective jurisdictions to ensure compliance and effective risk management.

Penalties and Noncompliance Consequences

Noncompliance with workers' compensation laws can have serious consequences for employers. Penalties for noncompliance can include fines, criminal charges, and potential legal liability. In some cases, noncompliant employers may also be barred from participating in public contracts or face other business restrictions.

Additionally, failing to provide workers' compensation coverage leaves employers exposed to potential lawsuits from injured employees. Without the protection of workers' compensation insurance, employers may be liable for medical expenses, lost wages, and other damages resulting from work-related injuries or illnesses.

Employers should prioritize compliance with workers' compensation laws and regulations, seeking guidance from insurance professionals and legal counsel to ensure they meet their obligations and protect their employees and businesses.

Future Outlook and Predictions

As we conclude this comprehensive guide, it is important to consider the future outlook of workers' compensation insurance rates. While predicting the exact trajectory of rates is challenging, several factors and trends provide insights into potential developments in the field:

Technological Advancements

The advancement of technology is likely to have a significant impact on workers' compensation rates. Emerging technologies, such as wearables, Internet of Things (IoT) devices, and artificial intelligence, enable employers to collect real-time data on workplace safety and monitor employee health and well-being. This data-driven approach can help identify risks, implement preventive measures, and reduce the frequency and severity of workplace injuries. As technology continues to evolve, it may contribute to more accurate risk assessments and potentially lower workers' compensation rates.

Legislative Reforms and Regulatory Changes

Legislative reforms and changes in workers' compensation regulations can significantly impact rates. As societal and workplace dynamics evolve, lawmakers may introduce reforms to address emerging issues, enhance worker protections, or promote cost containment. These reforms can influence benefit structures, coverage requirements, and the overall cost of workers' compensation insurance. Employers should stay informed about legislative developments and engage with industry associations and insurance professionals to understand the potential impact on rates.

Shifting Workforce Demographics

The demographic composition of the workforce is changing, with demographic shifts influencing workers' compensation rates. As older workers delay retirement and remain in the workforce, the potential for age-related injuries and chronic conditions may increase, potentially impacting rates. Additionally, the rise of the gig economy and non-traditional employment arrangements may present unique challenges in determining workers' compensation rates and coverage for workers in these sectors.

Emerging Risks and Occupational Hazards

New industries, technologies, and work practices can introduce new risks and occupational hazards. As industries evolve and new occupations emerge, insurance carriers will need to assess and adapt their risk models and rating methodologies to accurately reflect these changes. For example, as the use of artificial intelligence and robotics increases, the risks associated with human-machine interactions may require specialized risk assessments and potentially impact rates.

Public Health and Pandemic Preparedness

The COVID-19 pandemic has highlighted the importance of public health and pandemic preparedness. Going forward, there may be increased emphasis on workplace safety measures, infectious disease control, and emergency response planning. Employers that prioritize and invest in robust safety protocols and pandemic preparedness may be rewarded with lower workers' compensation rates as insurance carriers recognize their proactive efforts to mitigate risks.

Data Analytics and Predictive Modeling

The advancement of data analytics and predictive modeling capabilities allows insurance carriers to refine their risk assessments and pricing models. By leveraging large datasets and advanced algorithms, carriers can better identify patterns, trends, and correlations that help predict the likelihood of workplace injuries. This increased precision in risk analysis can lead to more accurate and customized rates for businesses, reflecting their specific risk profiles.

Changing Social and Cultural Expectations

Social and cultural expectations regarding workplace safety, employee well-being, and fairness in compensation are evolving. There is a growing emphasis on the importance of creating safe and inclusive work environments. Employers that prioritize employee health and safety and demonstrate a commitment to worker well-being may be viewed more favorably, potentially leading to more competitive rates and enhanced reputation in the marketplace.

Global Influences and Economic Factors

Global influences and economic factors can also impact workers' compensation rates. Economic fluctuations, changes in labor markets, and global events can influence the overall cost of insurance and the risk landscape. Employers with operations in multiple countries or those exposed to international markets should be aware of these global influences and consider their potential impact on workers' compensation rates.

It is important for employers and insurance professionals to stay informed about these future trends and predictions to effectively manage workers' compensation costs and adapt to a dynamic landscape. Monitoring industry developments, engaging with industry associations, and collaborating with insurance professionals can provide valuable insights and help navigate the evolving workers' compensation landscape.

In conclusion, understanding the intricacies of workers' compensation insurance rates by state is crucial for employers, employees, and insurance professionals alike. By delving into the factors influencing rates, exploring state-by-state comparisons, and providing actionable strategies, this comprehensive guide equips readers with the knowledge needed to navigate the complex landscape of workers' compensation insurance rates effectively. As the field continues to evolve, staying informed, prioritizing workplace safety, and adapting to emerging trends will be key to managing workers' compensation costs and ensuring the well-being of employees.

Post a Comment for "Workers' Compensation Insurance Rates by State: A Comprehensive Guide"