Understanding Umbrella Insurance Policies and Pricing: A Comprehensive Guide

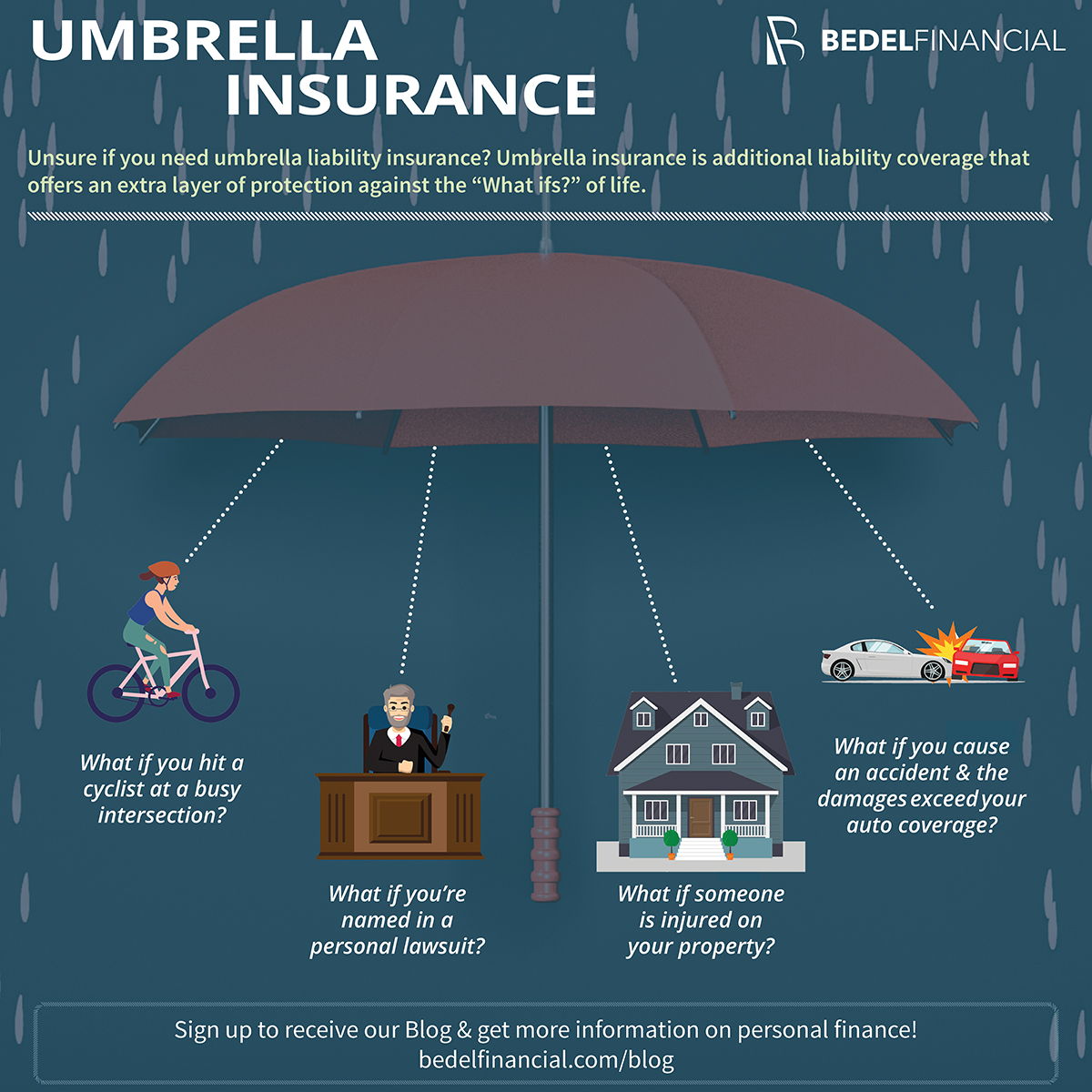

Umbrella insurance policies are often misunderstood and overlooked by many individuals, but they can provide valuable coverage and protection. In this comprehensive guide, we will delve into the intricacies of umbrella insurance policies and pricing to help you make an informed decision about whether this type of coverage is right for you.

First, let's start by understanding what umbrella insurance is. Essentially, it is an extra liability insurance that goes beyond the limits of your existing policies, such as your homeowners or auto insurance. This means that if you are involved in a major accident or face a significant lawsuit, your umbrella policy will kick in to provide additional coverage, often in the millions of dollars.

The Basics of Umbrella Insurance

In this section, we will cover the fundamental aspects of umbrella insurance, including what it covers, who needs it, and why it is essential to have this additional layer of protection. Understanding the basics will lay the foundation for the rest of our guide.

What does umbrella insurance cover?

Umbrella insurance provides coverage for liability claims that exceed the limits of your primary insurance policies. This can include bodily injury, property damage, libel, slander, and even certain lawsuits. It acts as a safety net, protecting your assets and future earnings in case of a catastrophic incident.

Who needs umbrella insurance?

While umbrella insurance is not mandatory, it is highly recommended for individuals with significant assets or higher risk exposure. If you own a home, have substantial savings, or engage in activities that may increase the likelihood of liability claims, such as owning rental properties or having a swimming pool, umbrella insurance can provide invaluable protection.

Why is umbrella insurance essential?

One of the primary reasons umbrella insurance is essential is the rising costs of lawsuits and settlements. In today's litigious society, even a seemingly minor accident can result in a substantial claim that exceeds the limits of your primary insurance. Without umbrella coverage, you may be personally responsible for paying these excess costs out of pocket, which can be financially devastating.

Factors Affecting Umbrella Insurance Pricing

Umbrella insurance pricing can vary greatly depending on several factors. In this section, we will explore the key elements that influence the cost of your policy. Understanding these factors will help you estimate the price you may expect to pay and ensure that you secure the right coverage at a fair price.

Your personal risk profile

Insurance companies assess your personal risk profile when determining the cost of your umbrella policy. Factors such as your age, occupation, driving record, and credit history can all impact the pricing. Generally, individuals with higher risk profiles, such as those with multiple driving violations or a history of lawsuits, may face higher premiums.

Coverage limits

The coverage limits you choose for your umbrella policy also play a significant role in pricing. The higher the coverage limits, the more protection the policy provides, but this typically results in higher premiums. It is crucial to assess your liability risks accurately and select appropriate coverage limits that align with your assets and potential exposure.

Underlying insurance policies

The underlying insurance policies that you have, such as auto or homeowners insurance, can impact umbrella insurance pricing. Insurance companies often require certain minimum limits on these primary policies to qualify for umbrella coverage. If your underlying policies have lower limits, it may affect the cost of your umbrella policy or even your eligibility for coverage.

Number of properties and vehicles

If you own multiple properties or vehicles, it can increase the cost of your umbrella insurance. Each additional property or vehicle adds to the potential liability exposure, which insurance companies take into consideration when pricing the policy. It is important to disclose all properties and vehicles accurately to ensure proper coverage and avoid any potential gaps.

Assessing Your Liability Risks

Before purchasing an umbrella insurance policy, it is crucial to assess your liability risks accurately. This section will guide you through the process of identifying potential risks and determining the appropriate coverage limits for your specific situation. By conducting a thorough analysis, you can ensure that you are adequately protected.

Evaluating your assets

Start by evaluating your assets, including your home, vehicles, investments, and savings. Consider their total value and how vulnerable they might be to potential liability claims. The higher your assets' value, the more critical it is to have sufficient coverage to protect them.

Reviewing your lifestyle

Review your lifestyle and activities that may increase your risk exposure. Do you frequently entertain guests at your home? Do you participate in high-risk sports or hobbies? Are you involved in any volunteer activities that might pose liability risks? Understanding these factors will help you assess the potential liability claims you may face.

Identifying potential risks

Identify potential risks specific to your circumstances. For example, if you have a swimming pool or own rental properties, there may be an increased likelihood of accidents or lawsuits. Analyze your surroundings, activities, and any other factors that may expose you to liability risks.

Consulting with an insurance professional

Consulting with an insurance professional can be invaluable in assessing your liability risks accurately. They can help you identify any potential gaps in your existing coverage and recommend appropriate coverage limits for your umbrella policy. An expert's guidance ensures that you have comprehensive protection and peace of mind.

Comparing Different Insurance Providers

Choosing the right insurance provider is just as important as selecting the appropriate coverage. In this section, we will outline the key factors to consider when comparing different insurers offering umbrella insurance policies. By conducting thorough research and evaluating your options, you can find a reputable provider that offers competitive pricing and reliable coverage.

Financial strength and reputation

Start by considering the financial strength and reputation of the insurance providers you are considering. Look for companies with high ratings from independent rating agencies, as this indicates their ability to meet their financial obligations. Additionally, read customer reviews and seek recommendations to gauge their reputation for customer service and claims handling.

Experience in umbrella insurance

Experience in providing umbrella insurance is another crucial factor to consider. Look for insurers with a track record of offering this type of coverage and handling claims effectively. An experienced insurer will have a deep understanding of the unique risks and challenges associated with umbrella insurance, ensuring that you receive proper guidance and support.

Policy coverage and exclusions

Review the coverage and exclusions offered by each insurance provider. While umbrella insurance typically covers a broad range of liabilities, there may be variations in the specific coverage offered. Pay close attention to any exclusions or limitations that may impact your needs. Ensure that the policy aligns with your risk profile and provides the necessary protection.

Premium pricing and discounts

Compare premium pricing from different insurers. While it is important to consider cost, remember that the cheapest option may not always be the best. Look for insurers that offer competitive pricing based on your risk profile and coverage needs. Additionally, inquire about any potential discounts that may be available, such as bundling your umbrella policy with other insurance policies you have.

Understanding Policy Exclusions and Limitations

While umbrella insurance provides extensive coverage, it is essential to be aware of its exclusions and limitations. This section will highlight common exclusions and limitations found in umbrella policies, ensuring that you have a clear understanding of what is covered and what is not.

Intentional acts

Most umbrella policies exclude coverage for intentional acts or criminal activities. If you intentionally cause harm to others or engage in illegal activities, your umbrella policy will not provide coverage for resulting liability claims. It is crucial to understand the boundaries of coverage and always act responsibly.

Business-related activities

Umbrella policies typically exclude coverage for business-related activities. If you are involved in a business venture or have rental properties, you may need separate liability coverage specific to those operations. Consult with your insurance provider to ensure that all your liability exposures are adequately covered.

Professional services

Professional services, such as medical or legal advice, are often excluded from umbrella insurance coverage. If you provide professional services, you may need to consider obtaining separate professional liability insurance to protect yourself from related claims. Review the policy exclusions carefully to understand the scope of coverage.

Contractual liability

Many umbrella policies exclude contractual liabilities. If you assume liability through a contract or agreement, such as a lease or indemnification agreement, your umbrella policy may not provide coverage for those specific liabilities. It is crucial to review your contracts carefully and consider obtaining separate liability coverage if necessary.

Umbrella Insurance vs. Excess Liability Insurance

Confused about the difference between umbrella insurance and excess liability insurance? This section will compare and contrast the two types of coverage, helping you determine which one suits your needs best. Understanding the nuances between these options will allow you to make an informed decision.

Primary coverage requirements

Excess liability insurance requires that you maintain specific underlying limits on your primary insurance policies. In contrast, umbrella insurance may provide broader coverage in terms of underlying policies and may not have the same strict requirements. Consider your existing primary coverage and any potential limitations when choosing between the two options.Scope of coverage

Excess liability insurance typically provides coverage only for the specific types of liability covered by the underlying policies. On the other hand, umbrella insurance offers more comprehensive coverage, often extending beyond the underlying policies. This broader scope of coverage can be advantageous in providing additional protection for a wider range of liability risks.

Premium cost

The cost of excess liability insurance is generally lower than umbrella insurance. This is because excess liability insurance provides coverage that is more limited in scope compared to umbrella insurance. However, it is essential to evaluate your specific needs and potential risks to determine if the cost savings of excess liability insurance outweigh the benefits of broader coverage offered by umbrella insurance.

Flexibility and convenience

Umbrella insurance offers greater flexibility and convenience compared to excess liability insurance. With umbrella insurance, you can often consolidate your coverage under a single policy, making it easier to manage and understand your liability protection. Additionally, umbrella insurance may provide coverage for certain liabilities that are not covered by any underlying policies, giving you added peace of mind.

Determining the Right Coverage Limits

Choosing appropriate coverage limits for your umbrella policy is crucial. In this section, we will discuss the various factors to consider when determining the right coverage limits, such as your assets, potential risks, and financial situation. By analyzing these factors, you can secure adequate protection without overpaying for unnecessary coverage.

Evaluating your assets and net worth

Begin by evaluating your assets and net worth to determine the appropriate coverage limits. Your coverage should be sufficient to protect your assets and future earnings from potential liability claims. Consider the total value of your assets, including your home, vehicles, investments, and savings. Additionally, assess your net worth to gauge your ability to cover any potential excess costs in the event of a lawsuit.

Assessing potential risks and exposures

Assess the potential risks and exposures you face to determine the appropriate coverage limits. Consider factors such as your lifestyle, hobbies, and any business activities. Evaluate the likelihood and severity of potential liability claims that may arise from these activities. This analysis will help you gauge the level of protection needed to safeguard your assets and future earnings.

Considering state-specific requirements

Some states have specific requirements or regulations regarding the minimum coverage limits for umbrella insurance. Research the laws in your state to ensure that you meet the necessary thresholds. Keep in mind that while state requirements provide a baseline, it may be prudent to consider higher coverage limits if your assets or risks warrant additional protection.

Consulting with a financial advisor or insurance professional

Consulting with a financial advisor or insurance professional can provide valuable insights when determining the right coverage limits. They can assess your financial situation, risk profile, and potential exposures to provide guidance on appropriate coverage limits. Their expertise will help ensure that you strike the right balance between protection and affordability.

Umbrella Insurance Riders and Additional Coverages

Besides the core coverage, umbrella insurance policies often offer additional options and riders to enhance your protection. This section will explore popular riders and additional coverages, providing insights into whether these add-ons are worth considering for your specific needs.

Personal injury coverage

Personal injury coverage is a common rider offered by umbrella insurance policies. It extends coverage to claims related to libel, slander, defamation, invasion of privacy, and other personal injuries. If you engage in activities that may expose you to these types of claims, such as being active on social media or being involved in public speaking, personal injury coverage can provide valuable protection.

Uninsured/underinsured motorist coverage

Uninsured/underinsured motorist coverage is another essential rider to consider, especially if you frequently drive or have a higher risk of accidents. This coverage protects you in case you are involved in an accident with a driver who either has no insurance or insufficient insurance to cover your damages. It ensures that you are not left financially vulnerable in such situations.

Excess property damage coverage

If you own valuable assets, such as high-end vehicles or luxury properties, excess property damage coverage can provide additional protection. This rider increases the coverage limits for property damage claims, ensuring that you are adequately covered in case of significant damage to your assets.

Legal defense costs

Legal defense costs can quickly add up in the event of a lawsuit. Some umbrella insurance policies offer coverage for legal defense costs, ensuring that you have financial assistance to hire legal representation. This coverage can be crucial in protecting your assets and providing peace of mind in case of a legal dispute.

Frequently Asked Questions about Umbrella Insurance

In this section, we will address frequently asked questions that individuals often have about umbrella insurance. From clarifying common misconceptions to providing guidance on specific scenarios, these answers will help you gain a comprehensive understanding of umbrella insurance policies and pricing.

Is umbrella insurance expensive?

The cost of umbrella insurance varies depending on several factors, such as your risk profile, coverage limits, and insurance provider. While it may require an additional premium, many individuals find the cost to be reasonable considering the significant protection it provides. It is best to obtain quotes from multiple insurers and compare coverage options to find the most suitable and affordable policy for your needs.

Do I need umbrella insurance if I have homeowners and auto insurance?

While homeowners and auto insurance provide liability coverage, their limits may not be sufficient to protect you in the event of a significant claim or lawsuit. Umbrella insurance acts as an extra layer of protection, extending the coverage beyond the limits of your primary policies. If you have substantial assets or face higher liability risks, umbrella insurance is highly recommended to ensure adequate protection.

Can I choose my coverage limits for umbrella insurance?

Yes, you can typically choose your coverage limits for umbrella insurance. However, insurance companies may have minimum requirements that you must meet to qualify for coverage. It is important to assess your assets, potential risks, and financial situation to determine the appropriate coverage limits. Consulting with an insurance professional can help you make an informed decision based on your specific needs.

Does umbrella insurance cover professional liability?

Umbrella insurance typically does not cover professional liability, which includes claims related to professional services or advice. If you provide professional services, consider obtaining a separate professional liability insurance policy to protect yourself from these specific risks. Review the policy exclusions carefully and consult with your insurance provider to ensure that you have the necessary coverage for all your liability exposures.

The Importance of Regular Policy Reviews

Lastly, we will emphasize the significance of regularly reviewing your umbrella insurance policy. Changes in your life circumstances, assets, or even insurance providers can warrant a policy review. This section will explain why it is essential to stay proactive and ensure that your umbrella coverage aligns with your current needs.

Life changes and new assets

Life changes such as marriage, the birth of a child, or significant asset acquisitions should prompt a review of your umbrella insurance coverage. These changes may necessitate adjustments to your coverage limits to ensure that you have adequate protection for your expanded responsibilities and assets.

Changes in risk exposure

If you engage in new activities or hobbies that increase your risk exposure, it is crucial to review your umbrella insurance policy. For example, if you start a home-based business or purchase a vacation rental property, these changes may require additional coverage or adjustments to your existing policy. Regular reviews help identify any gaps or limitations in your coverage.

Policy exclusions and limitations

Policy exclusions and limitations may change over time or vary between insurance providers. Regular policy reviews allow you to stay informed about any updates or modifications to your coverage. By understanding the scope of coverage and any potential limitations, you can address any gaps and ensure that your policy aligns with your needs.

Changes in insurance providers

If you switch insurance providers, it is essential to review your umbrella insurance policy. Coverage and pricing may vary between insurers, and it is crucial to ensure that your new policy provides comparable or improved coverage at a competitive price. A policy review will help you make an informed decision and avoid any potential gaps in coverage during the transition.

In conclusion, understanding umbrella insurance policies and pricing is crucial for protecting yourself from potential liability risks. By exploring the basics, assessing your risks, comparing providers, and delving into policy details, you can make informed decisions about your coverage. Remember to regularly review your policy to adapt to any changes in your circumstances or needs. With the knowledge gained from this comprehensive guide, you can confidently navigate the world of umbrella insurance and safeguard your financial future.

Post a Comment for "Understanding Umbrella Insurance Policies and Pricing: A Comprehensive Guide"