Understanding the Cost Estimate of Commercial Liability Insurance

Commercial liability insurance is a crucial aspect of any business, providing protection against financial losses resulting from lawsuits or claims filed by third parties. However, before purchasing such insurance, it is essential to have a clear understanding of the estimated cost. This blog article aims to provide comprehensive information about the factors influencing commercial liability insurance costs and how to estimate them accurately.

In this article, we will delve into the various aspects that impact the cost of commercial liability insurance. By understanding these factors, business owners can make informed decisions and ensure they have adequate coverage without breaking the bank.

Industry-specific risks

Every industry has its unique risks and exposures, which directly impact the cost of commercial liability insurance. Understanding these risks is crucial for business owners to assess the level of coverage they require and estimate the associated costs.

Inherent Risks

Each industry has inherent risks associated with its operations. For example, the construction industry faces risks related to accidents on construction sites or property damage, while the healthcare industry faces risks associated with medical malpractice or patient injury. Insurers consider these inherent risks when determining premium rates for commercial liability insurance.

Claims History and Loss Ratios

The claims history and loss ratios within your industry can significantly affect the cost of insurance. If your industry has a high frequency of claims or a history of substantial losses, insurers may charge higher premiums to offset the potential risk. Conversely, industries with low claims history and favorable loss ratios may benefit from lower insurance costs.

Regulatory Compliance

The level of regulatory compliance required for your industry can also impact the cost of commercial liability insurance. Industries with stringent regulations may face higher insurance costs due to the increased potential for lawsuits and regulatory penalties. Insurers consider the regulatory landscape when assessing the risk exposure of a business and determining premium rates.

Business Size and Revenue

The size of your business and its revenue play significant roles in determining the cost of commercial liability insurance. Insurers evaluate these factors to assess the financial stability of a business and estimate the potential losses they may incur.

Employee Count

The number of employees within your business can influence insurance costs. Generally, larger businesses with more employees may face higher premiums due to the increased exposure to potential lawsuits or claims. Insurers consider the number of employees when determining the probability of a claim and the potential financial impact it may have.

Annual Revenue

The annual revenue of your business is another factor insurers consider when estimating the cost of commercial liability insurance. Higher revenue usually indicates a larger business operation, which may lead to increased risks and potential financial losses. Consequently, businesses with higher revenues may face higher premium rates to account for these increased exposures.

Projected Growth

Insurers may also consider the projected growth of your business when determining the cost of insurance. If your business is expected to experience significant growth in the future, insurers may account for the increased risks and potential liabilities associated with expansion. This projection can impact the premium rates offered to ensure adequate coverage for future business operations.

Claims History

Your claims history can significantly impact the cost of commercial liability insurance. Insurers assess your claims history to evaluate the likelihood of future claims and determine the level of risk associated with your business.

Claim Frequency

The frequency at which you have filed claims in the past can affect your insurance costs. Businesses with a history of frequent claims may be perceived as higher risk by insurers, leading to higher premium rates. Insurers consider the number of claims filed within a specific timeframe to assess the potential for future claims and the overall risk exposure of your business.

Claim Severity

The severity of your past claims can also impact the cost of commercial liability insurance. If your previous claims resulted in significant financial losses for the insurer, they may adjust your premium rates accordingly. Insurers consider the monetary value of past claims when estimating the potential impact on future claims and the overall cost of providing coverage.

Loss Control Measures

Implementing effective loss control measures can positively influence the cost of commercial liability insurance. Insurers may offer lower premium rates to businesses with robust risk management practices in place. By demonstrating proactive measures to mitigate potential risks, such as safety training programs or regular equipment maintenance, you can showcase your commitment to minimizing losses and potentially reduce insurance costs.

Coverage Limits and Deductibles

Choosing appropriate coverage limits and deductibles is crucial to strike a balance between affordability and adequate protection. Understanding the impact of coverage limits and deductibles on insurance costs is essential when estimating the overall expense of commercial liability insurance.

Higher Coverage Limits

Opting for higher coverage limits can provide increased protection for your business but may result in higher premium rates. Insurers consider the potential financial exposure your business may face in the event of a claim when determining the cost of insurance. By evaluating your specific needs and potential risks, you can choose coverage limits that align with your business requirements without overpaying for unnecessary coverage.

Lower Deductibles

Lower deductibles mean that the insurer covers a higher percentage of the claim amount. While this may provide more immediate financial relief in the event of a claim, it often leads to higher premium rates. Insurers consider the level of risk-sharing between the insured and the insurer when assessing the cost of commercial liability insurance. By carefully evaluating your business's financial capabilities and risk tolerance, you can select deductibles that strike the right balance between affordability and coverage.

Tailored Coverage

Opting for tailored coverage that aligns with your business's specific needs can impact the cost of commercial liability insurance. Generic policies may include coverage that may not be relevant to your business, leading to higher premiums. By customizing your insurance coverage to address the unique risks and exposures of your industry, you can potentially reduce insurance costs while ensuring comprehensive protection.

Location and Jurisdiction

The location of your business and the jurisdiction in which you operate can impact insurance costs. Local factors, such as the legal environment and historical claim data, influence the pricing of commercial liability insurance.

Legal Environment

Each jurisdiction has its unique legal environment, which can affect the cost of commercial liability insurance. Some jurisdictions may have a higher propensity for lawsuits or stricter regulations, leading to increased insurance costs. Insurers consider the legal landscape when estimating the potential risk exposure of your business and determining premium rates.

Historical Claim Data

Insurers analyze historical claim data within specific locations to assess the potential risk exposure and estimate insurance costs. If your business operates in an area with a high frequency of claims or substantial losses, insurers may charge higher premiums to offset the increased risk. Understanding the claim history within your location can help you estimate the potential insurance costs more accurately.

Type of Coverage and Endorsements

There are various types of commercial liability insurance, and each comes with its unique costs. Understanding the different coverage options and potential endorsements relevant to your business is crucial for estimating the cost of insurance accurately.

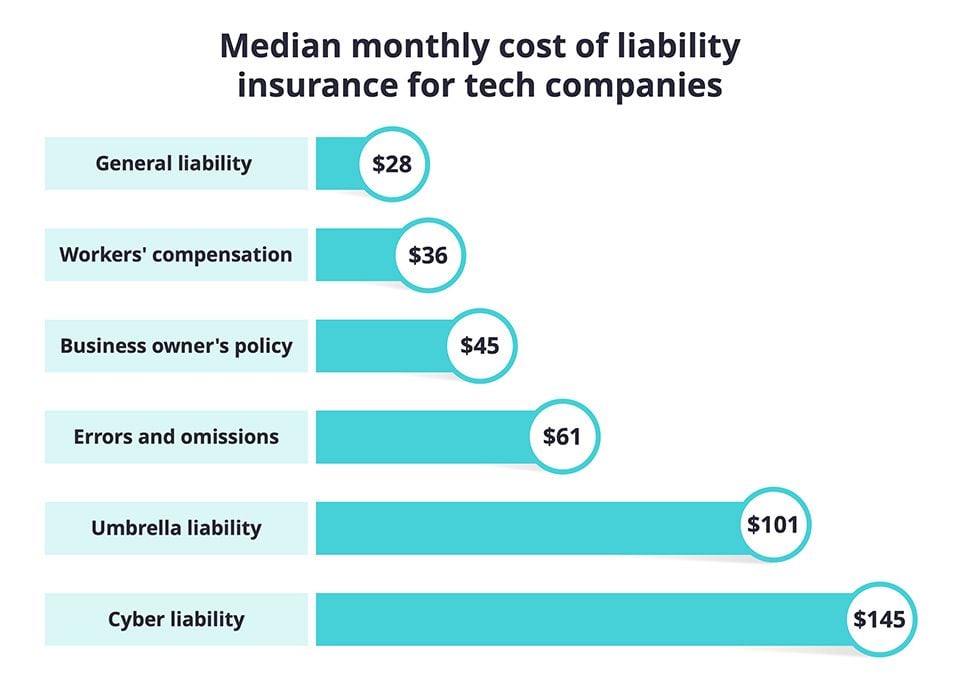

General Liability Insurance

General liability insurance provides coverage for bodily injury, property damage, and personal injury claims. The cost of general liability insurance varies depending on the nature of your business, the risks associated with your operations, and the coverage limits selected. Insurers consider factors such as the industry, annual revenue, and claims history when determining premium rates for general liability insurance.

Professional Liability Insurance

Professional liability insurance, also known as errors and omissions insurance, provides coverage for claims arising from professional services or advice. The cost of professional liability insurance depends on factors such as the industry, the level of expertise required, and the potential financial impact of errors or omissions. Insurers assess the risk exposure of your business and the potential for professional negligence when estimating premium rates for professional liability insurance.

Product Liability Insurance

Product liability insurance covers claims arising from injuries or damages caused by products your business manufactures, distributes, or sells. The cost of product liability insurance varies based on factors such as the type of products, the level of risk associated with their use, and the claims history of similar businesses. Insurers evaluate the potential for product-related claims and the potential financial losses when determining premium rates for product liability insurance.

Additional Endorsements

Depending on your business's specific needs, additional endorsements may be necessary to enhance your coverage. These endorsements can include coverage for cyber liability, employment practices liability, or liquor liability, among others. The cost of these endorsements may vary based on the level of risk exposure associated with each endorsement and the potential financial impact of claims. Insurers consider the specific endorsements selected when estimating the overall cost of commercial liability insurance.

Risk Management Practices

Implementing effective risk management practices can help reduce the cost of commercial liability insurance. Insurers appreciate businesses that actively manage their risks, as it demonstrates a commitment to minimizing potential claims and financial losses.

Safety Training Programs

Developing and implementing safety training programs for employees can positively impact the cost of commercial liability insurance. Insurers may offer lower premium rates to businesses that prioritize employee safety and provide ongoing training to mitigate potential risks. By investing in safety training programs, you can reduce the likelihood of accidents or injuries and potentially lower insurance costs.Regular Equipment Maintenance

Regular equipment maintenance is essential for businesses that rely on machinery or equipment. By implementing a proactive maintenance schedule, you can reduce the risk of equipment failure or malfunctions that may result in accidents or property damage. Insurers take into account your maintenance practices when assessing the potential risk exposure of your business and may offer lower premium rates to those who demonstrate a commitment to equipment safety.

Documented Policies and Procedures

Having clearly documented policies and procedures in place is crucial for effective risk management. Insurers value businesses that have comprehensive guidelines outlining safety protocols, emergency response procedures, and incident reporting mechanisms. By demonstrating a proactive approach to risk management through documented policies, you can potentially reduce insurance costs and mitigate potential claims.

Claims Management Strategies

Efficient claims management strategies can also impact the cost of commercial liability insurance. By promptly reporting and managing claims, you demonstrate your commitment to resolving issues efficiently and minimizing potential financial losses. Insurers appreciate businesses that have effective claims management processes in place and may offer lower premium rates as a result.

Regular Risk Assessments

Conducting regular risk assessments is vital for identifying potential vulnerabilities within your business operations. By proactively identifying and addressing risks, you can reduce the likelihood of accidents or incidents that may lead to liability claims. Insurers recognize the value of comprehensive risk assessments and may offer lower premium rates to businesses that prioritize ongoing risk evaluation and mitigation.

Insurer Selection and Competition

The choice of insurer and the competitive landscape can influence insurance costs. By carefully selecting an insurer and leveraging competition, you can potentially negotiate favorable premium rates.

Research Multiple Insurers

It is essential to research and compare multiple insurers before selecting one for your commercial liability insurance. Each insurer has its underwriting guidelines and pricing strategies. By obtaining quotes from different insurers, you can compare the coverage options and premium rates offered. This allows you to make an informed decision and potentially secure more competitive pricing.

Consider Specialty Insurers

Depending on your industry, it may be beneficial to consider specialty insurers that cater specifically to businesses in your sector. Specialty insurers often have a deeper understanding of the risks associated with your industry and may offer more tailored coverage options. By working with insurers experienced in your field, you can potentially access more competitive premiums that accurately reflect your risk exposure.

Negotiate Premium Rates

Insurance premiums are not always fixed, and there is often room for negotiation. Once you have received quotes from multiple insurers, you can leverage this information to negotiate with your preferred insurer. Highlighting your business's positive attributes, such as low claims history, risk management practices, or loyalty to the insurer, can strengthen your bargaining position. By actively negotiating, you may secure more favorable premium rates for your commercial liability insurance.

Utilize Insurance Brokers

Insurance brokers can be valuable resources when it comes to selecting an insurer and navigating the insurance market. These professionals have in-depth knowledge of different insurers and their pricing structures. By working with an insurance broker, you can tap into their expertise and potentially gain access to exclusive deals or discounts. Insurance brokers can also assist in negotiating premium rates on your behalf, ensuring you receive the most competitive pricing available.

Premium Payment Options

The method you choose for paying your insurance premiums can impact the overall cost of commercial liability insurance. Understanding the different payment options available allows you to manage expenses effectively.

Annual Payments

Opting for annual premium payments can often result in cost savings. Many insurers offer discounts for businesses that pay their premiums in a lump sum at the beginning of the policy term. By paying annually, you can potentially reduce the overall cost of insurance compared to monthly or quarterly payment options.

Installment Plans

Some insurers provide installment plans that allow businesses to spread their premium payments throughout the policy term. While this can provide greater flexibility for budgeting, it is important to consider any additional fees or interest charges that may apply. Assessing the total cost of insurance when utilizing installment plans ensures you are fully informed about the expenses associated with your chosen payment method.

Automatic Bank Transfers

Setting up automatic bank transfers for premium payments can streamline the payment process and potentially eliminate any late payment fees. By authorizing the insurer to deduct premiums directly from your bank account, you ensure timely payments and avoid the risk of missing payment deadlines. Insurers may also offer discounts or incentives for businesses that choose automatic bank transfers as their preferred payment method.

Electronic Funds Transfer (EFT)

Electronic Funds Transfer (EFT) is another convenient payment option for commercial liability insurance. This method allows you to authorize insurers to withdraw premiums directly from your designated bank account. EFT payments are typically processed automatically, minimizing the risk of missed payments and associated penalties. Many insurers offer incentives, such as reduced administrative fees, for businesses that opt for EFT payments.

Seek Professional Advice

While estimating commercial liability insurance costs, it is always beneficial to seek advice from insurance professionals. Insurance brokers or agents specializing in commercial insurance can provide tailored guidance based on your specific business needs.

Consulting an Insurance Broker

An insurance broker can assist you in navigating the complexities of commercial liability insurance. They have access to multiple insurers and can provide objective advice on coverage options, pricing, and risk management strategies. Insurance brokers understand the industry-specific nuances and can help you estimate insurance costs more accurately.

Expert Risk Assessment

Engaging an expert to conduct a comprehensive risk assessment of your business can provide valuable insights when estimating insurance costs. These professionals evaluate your operations, identify potential risks, and recommend risk management measures to minimize liabilities. By understanding your specific risk profile, you can better estimate the cost of commercial liability insurance.

Legal Counsel

Consulting legal counsel specializing in insurance law can offer additional guidance when estimating insurance costs. They can review policy terms, advise on coverage options, and ensure you have the appropriate protection in place. Legal professionals can also assist in negotiating with insurers to achieve more favorable premium rates.

In conclusion, estimating the cost of commercial liability insurance involves considering multiple factors such as industry-specific risks, business size, claims history, coverage limits, and location. By understanding these elements and seeking professional advice, business owners can make informed decisions and ensure they have adequate coverage to protect against potential financial losses. Remember, a comprehensive evaluation of your insurance needs is crucial to strike the right balance between affordability and protection.

Post a Comment for "Understanding the Cost Estimate of Commercial Liability Insurance"