Insurance Requirements for Rideshare Drivers: What You Need to Know

As ridesharing continues to gain popularity around the world, more and more individuals are considering becoming rideshare drivers. While driving for companies like Uber or Lyft can be a lucrative opportunity, it's crucial to be aware of the insurance requirements that come with the job. Understanding the insurance coverage you need as a rideshare driver is not only essential for your safety but also for protecting your finances in case of an accident or incident. In this comprehensive guide, we will delve into the insurance requirements for rideshare drivers, providing you with the information you need to make informed decisions.

The Basics of Rideshare Insurance

When it comes to insurance for rideshare drivers, there are some fundamental concepts you need to understand. First and foremost, it's important to recognize that personal auto insurance and commercial auto insurance are distinct entities. Personal auto insurance typically covers personal use of your vehicle, while commercial auto insurance is designed for business-related activities, such as ridesharing. As a rideshare driver, you are essentially engaging in commercial activities, which means relying solely on your personal auto insurance may not provide sufficient coverage in the event of an accident.

Personal Auto Insurance vs. Commercial Auto Insurance

Personal auto insurance policies are generally not intended to cover commercial activities such as ridesharing. Most personal auto insurance policies have exclusions for using your vehicle for hire or as a public or livery conveyance. If you're involved in an accident while driving for a rideshare company and your personal auto insurance provider discovers you were driving for hire, they may deny coverage for any damages or injuries. It's crucial to review your personal auto insurance policy and understand its limitations in relation to ridesharing.

On the other hand, commercial auto insurance is specifically designed to cover vehicles used for commercial purposes. However, purchasing a full commercial auto insurance policy can be expensive and may not be cost-effective for part-time rideshare drivers. This is where rideshare insurance endorsements or policies come into play, providing a more affordable alternative that bridges the gap between personal and commercial auto insurance.

Rideshare Insurance Endorsements

Rideshare insurance endorsements are add-ons to your existing personal auto insurance policy that provide coverage while you are driving for a rideshare company. They are typically offered by insurance companies to fill the coverage gaps that exist between personal auto insurance policies and the insurance coverage provided by rideshare companies. These endorsements are specifically tailored to meet the unique needs of rideshare drivers and ensure you are adequately protected.

Rideshare insurance endorsements may include coverage for liability, collision, comprehensive, and uninsured/underinsured motorist incidents. The coverage provided by these endorsements usually applies during different phases of driving for a rideshare company, such as when the rideshare app is off, when you are waiting for a ride request, and when you have accepted a ride request. It's important to carefully review and understand the coverage limits and exclusions of the rideshare insurance endorsement before purchasing it.

Personal Auto Insurance and Ridesharing

When it comes to personal auto insurance and ridesharing, it's essential to understand the potential coverage gaps that may exist. While some personal auto insurance policies may provide limited coverage during certain phases of ridesharing, many policies explicitly exclude coverage for any commercial activities. It's crucial to review your policy and consult with your insurance provider to determine the extent of coverage while driving for a rideshare company.

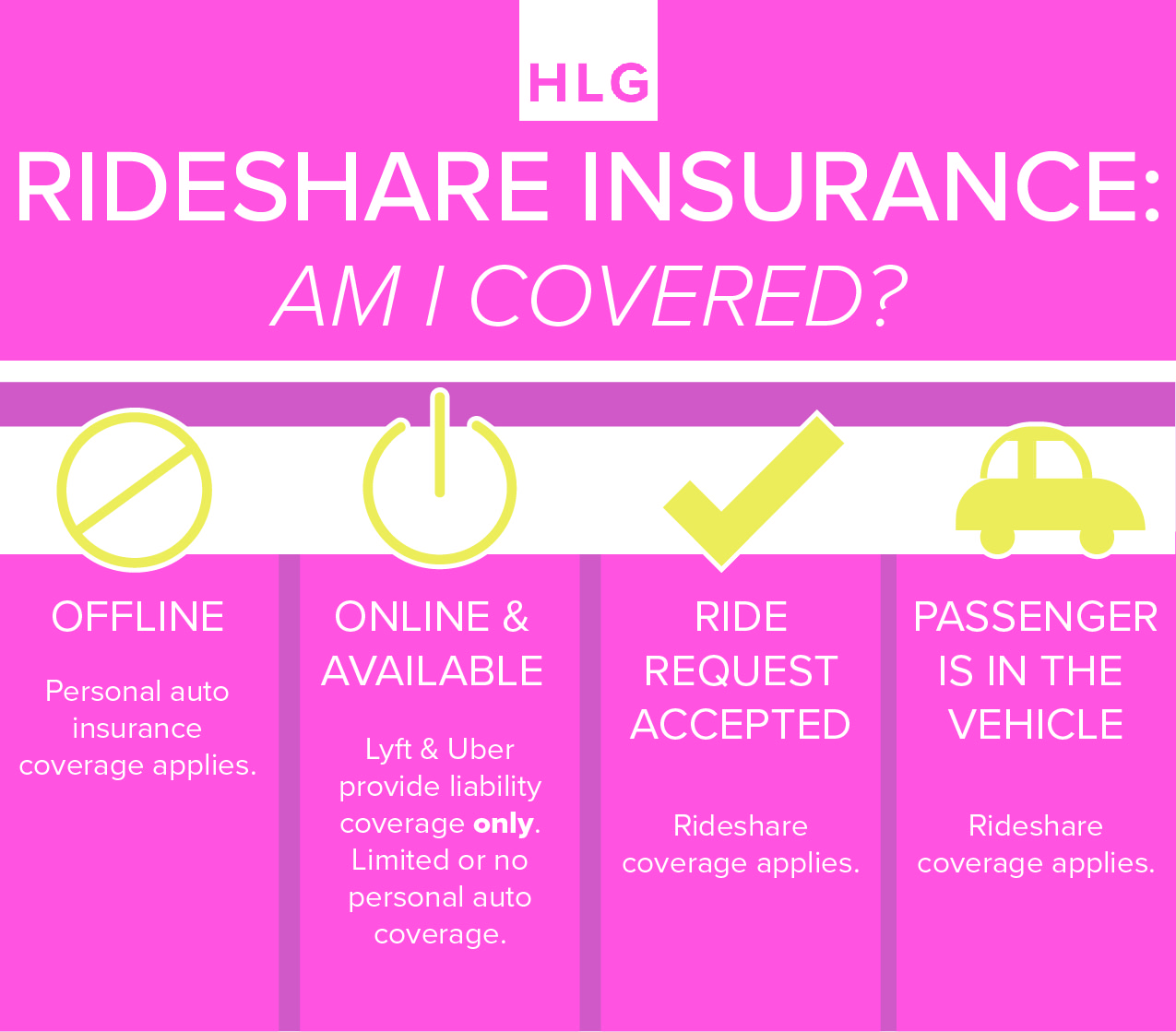

Coverage During App Off Period

During the period when your rideshare app is off and you are not actively available to accept ride requests, your personal auto insurance policy generally provides coverage as it would for any other personal use of your vehicle. This means that if you're involved in an accident while running personal errands or driving for non-commercial purposes, your personal auto insurance should cover the damages and injuries, subject to the policy's terms and conditions.

Coverage During Waiting Period

When your rideshare app is on, and you are waiting for a ride request, the coverage provided by your personal auto insurance policy may become limited or even excluded. Some insurance companies offer a hybrid policy that extends coverage during this waiting period, while others may require you to have a rideshare insurance endorsement in place to obtain coverage. It's important to clarify the terms of coverage during the waiting period with your insurance provider to avoid any surprises.

Coverage During Ride Period

The most critical phase when it comes to insurance coverage for rideshare drivers is during the ride period. This is when you have accepted a ride request and are transporting passengers to their destination. In many cases, personal auto insurance policies explicitly exclude coverage for accidents or incidents that occur during this phase of ridesharing. This is where the insurance coverage provided by the rideshare company itself comes into play, which we will explore further in the next section.

Rideshare Company Insurance

Rideshare companies like Uber and Lyft typically offer insurance coverage to their drivers. However, it's crucial to understand the limitations and exclusions of these policies and how they work in conjunction with your personal auto insurance. The coverage provided by rideshare company insurance generally applies only during specific phases of driving for the company and may have certain coverage limits.

Contingent Liability Coverage

During the ride period, rideshare companies typically provide contingent liability coverage. This means that if you are involved in an accident while transporting passengers, and your personal auto insurance denies coverage, the rideshare company's insurance may come into play. However, contingent liability coverage is generally secondary to your personal auto insurance. This means that your personal auto insurance must first deny the claim before the rideshare company's insurance kicks in. It's important to note that contingent liability coverage may have coverage limits and exclusions, so it's crucial to review the policy details provided by the rideshare company.

Contingent Collision and Comprehensive Coverage

Rideshare companies may also offer contingent collision and comprehensive coverage, which applies during the ride period. This coverage typically helps protect your vehicle in case of physical damage resulting from an accident or other covered incidents. Similar to contingent liability coverage, contingent collision and comprehensive coverage are usually secondary to your personal auto insurance coverage. It's important to note that deductibles and coverage limits may apply, so it's essential to review the policy details provided by the rideshare company.

Uninsured/Underinsured Motorist Coverage

Rideshare companies may also provide uninsured/underinsured motorist coverage, which protects you and your passengers if you're involved in an accident caused by another driver who is uninsured or underinsured. This coverage helps cover medical expenses and other damages that may result from such incidents. Review the policy details provided by the rideshare company to understand the coverage limits and conditions of this type of coverage.

Additional Insurance Options for Rideshare Drivers

In addition to personal auto insurance and the insurance coverage provided by rideshare companies, there are other insurance options available to rideshare drivers. These options can help ensure you have comprehensive coverage that addresses any potential gaps and provides you with peace of mind while driving for a rideshare company.

Rideshare Insurance Policies

Aside from rideshare insurance endorsements, some insurance companies offer standalone rideshare insurance policies. These policies are specifically designed to cover rideshare drivers and typically provide coverage throughout all phases of driving for a rideshare company. Rideshare insurance policies often offer higher coverage limits compared to rideshare endorsements and may include additional benefits tailored to the needs of rideshare drivers.

Commercial Auto Insurance

If you are a full-time rideshare driver or if your personal auto insurance policy does not provide coverage for ridesharing, obtaining a commercial auto insurance policy may be necessary. Commercial auto insurance is specifically designed for vehicles used for business purposes, such as ridesharing. While commercial auto insurance can be more expensive than personal auto insurance, it provides comprehensive coverage for your vehicle and potential liability claims.

Umbrella Insurance

Umbrella insurance is an additional liability insurance policy that provides coverage beyond the limits of your primary auto insurance. It can be a valuable option for rideshare drivers who want to have an extra layer of protection in case of a severe accident or lawsuit. Umbrella insurance typically provides coverage for both personal and commercial activities, making it a versatile solution for rideshare drivers.

State-Specific Insurance Requirements

Insurance requirements for rideshare drivers can vary from state to state. It's essential to familiarize yourself with the specific regulations and requirements in your state to ensure you are in compliance with the law and adequately protected. Some states have implemented legislation that mandates certain insurance coverage for rideshare drivers, while others may have specific requirements regarding minimum liability coverage limits.

Minimum Liability Coverage Limits

Many states have set minimum liability coverage limits for rideshare drivers, which are typically higher than the minimum limits for personal auto insurance. These higher limits reflect the increased potential risks associated with driving for a rideshare company. It's important to ensure that your insurance policy meets or exceeds the minimum liability coverage limits set by your state to avoid any penalties or gaps in coverage.

State-Specific Insurance Forms or Filings

In some states, rideshare drivers may be required to submit specific insurance forms or filings to the state's department of motor vehicles or insurance regulatory agency. These forms or filings are typically used to demonstrate proof of insurance coverageand compliance with the state's rideshare regulations. It's crucial to understand and fulfill any state-specific requirements to ensure you are operating legally as a rideshare driver and have the necessary insurance coverage in place.

Understanding Liability and Collision Coverage

Liability and collision coverage are two essential components of insurance for rideshare drivers. Understanding how these coverages work and their importance can help you make informed decisions when selecting insurance options.

Liability Coverage

Liability coverage is designed to protect you in case you are found at fault for an accident that results in bodily injury or property damage to others. This coverage helps cover medical expenses, property repairs, and legal costs associated with a liability claim. As a rideshare driver, liability coverage is crucial because you are responsible for the safety of your passengers and other road users while driving for a rideshare company.

It's important to note that liability coverage is typically split into two parts: bodily injury liability and property damage liability. Bodily injury liability coverage helps cover medical expenses, lost wages, and other damages for injured parties, while property damage liability coverage helps cover repairs or replacement costs for damaged property. Ensure that your insurance policy provides adequate limits for both bodily injury and property damage liability to protect yourself financially in case of an accident.

Collision Coverage

Collision coverage is designed to help cover the cost of repairing or replacing your vehicle in case of a collision, regardless of who is at fault. This coverage is particularly important for rideshare drivers because any damage to your vehicle can impact your ability to continue driving and earning income. Whether it's a fender bender or a more significant collision, collision coverage ensures that you have the necessary financial protection to repair or replace your vehicle.

It's important to understand the deductible associated with collision coverage. The deductible is the amount you are responsible for paying out of pocket before your insurance coverage kicks in. Consider your financial situation and the value of your vehicle when selecting a deductible. A higher deductible can help lower your insurance premiums but also means you will have to pay more in the event of a claim, while a lower deductible offers more immediate financial relief but may result in higher premiums.

Uninsured/Underinsured Motorist Coverage

Uninsured/underinsured motorist (UM/UIM) coverage is an important type of insurance for rideshare drivers. This coverage protects you and your passengers if you are involved in an accident caused by a driver who does not have insurance or does not have sufficient insurance to cover the damages and injuries sustained.

Underinsured Motorist Coverage

Underinsured motorist coverage comes into play when the at-fault driver's insurance coverage is not enough to fully compensate you for your damages and injuries. This coverage helps bridge the gap between the at-fault driver's coverage limits and the actual costs incurred. Without underinsured motorist coverage, you may be left with out-of-pocket expenses if the at-fault driver does not have adequate insurance.

Uninsured Motorist Coverage

Uninsured motorist coverage protects you in case you are involved in an accident with a driver who does not have any insurance coverage at all. If you are injured or your vehicle is damaged in such an incident, uninsured motorist coverage can help cover the medical expenses, property repairs, and other damages that you would otherwise have to pay for out of pocket.

Both uninsured and underinsured motorist coverage are important for rideshare drivers because they provide an extra layer of protection beyond the liability coverage provided by your personal auto insurance or the rideshare company's insurance. It ensures that you are not left financially vulnerable if you are involved in an accident with an uninsured or underinsured driver.

Deductibles, Limits, and Policy Considerations

When selecting insurance coverage as a rideshare driver, there are several important factors to consider, including deductibles, limits, and other policy considerations. Understanding these factors can help you make the right choices to protect yourself and your finances.

Deductibles

A deductible is the amount you agree to pay out of pocket before your insurance coverage begins. When choosing an insurance policy as a rideshare driver, consider the deductible amount and how it aligns with your financial situation. A higher deductible typically results in lower insurance premiums, while a lower deductible means you will have to pay less out of pocket in the event of a claim. Evaluate your risk tolerance and ability to cover the deductible when selecting your insurance policy.

Limits

Limits refer to the maximum amount your insurance policy will pay for a covered claim. When it comes to liability coverage, it's essential to select limits that adequately protect you in case of an accident. Consider the potential costs of medical expenses, property damage, and legal fees when determining the appropriate liability coverage limits. Additionally, review the limits for uninsured/underinsured motorist coverage and collision coverage to ensure they align with your needs and potential risks.

Policy Considerations

When reviewing insurance policies as a rideshare driver, there are several other factors to consider. Look for policies that offer coverage throughout all phases of driving for a rideshare company, including the waiting period and the ride period. Review any exclusions or limitations that may apply to your coverage, such as restrictions on driving in certain locations or carrying specific types of passengers.

Consider the reputation and financial stability of the insurance company before purchasing a policy. It's important to choose an insurer that has a history of reliable claims handling and customer service. Research customer reviews and ratings to gain insights into the experiences of other rideshare drivers with the insurer.

Consult with an Insurance Professional

Choosing the right insurance coverage as a rideshare driver can be complex. It's advisable to consult with an insurance professional who specializes in rideshare insurance. They can help assess your specific needs, explain the intricacies of different policies, and provide guidance on selecting the most appropriate coverage for your situation.

Insurance Tips and Best Practices

Navigating the insurance landscape as a rideshare driver can be challenging. Here are some insurance tips and best practices to help you make the most of your coverage and protect yourself financially.

Review Your Personal Auto Insurance Policy

Start by reviewing your personal auto insurance policy to understand its coverage limitations and exclusions when it comes to ridesharing. Be aware of any potential gaps in coverage during different phases of driving for a rideshare company. If necessary, contact your insurance provider to discuss your rideshare activities and explore options for additional coverage.

Research Rideshare Company Insurance

Take the time to research and understand the insurance coverage provided by the rideshare company you are driving for. Review the policy details, including coverage limits and exclusions. Familiarize yourself with the insurance company that underwrites the policy and their reputation for handling claims. Knowing the details of the rideshare company's insurance coverage can help you make informed decisions about obtaining additional coverage.

Consider Rideshare Insurance Endorsements

If your personal auto insurance policy does not provide coverage during the waiting or ride periods, consider purchasing a rideshare insurance endorsement. These endorsements are designed specifically for rideshare drivers and can help fill the coverage gaps that exist between personal auto insurance and the insurance provided by rideshare companies. Research different insurance companies that offer these endorsements and compare coverage options and pricing to find the best fit for your needs.

Explore Additional Insurance Options

Depending on your specific situation and needs, exploring additional insurance options may be beneficial. Consider standalone rideshare insurance policies or commercial auto insurance if your personal auto insurance does not adequately cover your rideshare activities. Evaluate umbrella insurance as well, as it can provide an extra layer of liability protection beyond the limits of your primary auto insurance.

Save on Premiums

Insurance premiums can be a significant expense for rideshare drivers. To save on premiums, consider bundling your rideshare insurance with other policies, such as renters or homeowners insurance, to take advantage of multi-policy discounts. Additionally, maintaining a clean driving record and completing defensive driving courses can help demonstrate your commitment to safe driving and potentially reduce your insurance premiums.

Document and Report Accidents Promptly

In the event of an accident, it's important to document the incident and report it promptly to your insurance company. Take photos of the scene, gather contact information from involved parties and witnesses, and file a police report if necessary. Promptly notifying your insurance company allows them to begin the claims process and ensures you receive the necessary support and coverage during this time.

Stay Informed and Review Coverage Regularly

Insurance requirements and regulations for rideshare drivers may change over time. Stay informed about any updates or changes in your state's insurance requirements and review your coverage regularly to ensure it still meets your needs. As your driving habits or circumstances change, consider adjusting your coverage accordingly to maintain appropriate protection.

The Future of Rideshare Insurance

The rideshare industry and the insurance landscape continue to evolve. As the popularity of ridesharing grows and new regulations are implemented, the future of rideshare insurance is likely to see further developments. Stay informed about any changes or advancements in rideshare insurance to ensure you are up to date with the latest coverage options and requirements.

Advancements in technology may lead to insurance products specifically tailored to rideshare drivers, offering more comprehensive coverageand streamlined claims processes. Insurance companies may develop innovative solutions that leverage telematics or usage-based insurance to provide more accurate and personalized coverage for rideshare drivers.

Additionally, regulatory bodies may continue to refine insurance requirements for rideshare drivers to ensure adequate protection for both drivers and passengers. This could include implementing standardized insurance policies or establishing minimum coverage limits that rideshare drivers must maintain.

The emergence of autonomous vehicles may also impact rideshare insurance in the future. As self-driving cars become more prevalent in ridesharing services, insurance policies may need to adapt to address the unique risks and liabilities associated with this technology. Insurance companies and rideshare companies may collaborate to develop specialized policies that cover both human-driven and autonomous rideshare vehicles.

It's important for rideshare drivers to stay informed about these potential future developments in rideshare insurance. Regularly checking for updates from insurance providers, industry news sources, and rideshare companies can help you stay ahead of any changes and ensure that you have the most appropriate and up-to-date coverage for your rideshare activities.

In conclusion, as a rideshare driver, understanding the insurance requirements and options available to you is crucial for your safety and financial well-being. Personal auto insurance policies may have limitations and exclusions when it comes to ridesharing, so it's important to review your policy and consider additional coverage options like rideshare insurance endorsements or standalone policies. Familiarize yourself with the insurance coverage provided by the rideshare company you drive for and explore additional options such as commercial auto insurance or umbrella insurance if needed. Stay informed about state-specific insurance requirements and keep your coverage up to date to ensure compliance and adequate protection. By being proactive and knowledgeable about rideshare insurance, you can drive with confidence and peace of mind.

Post a Comment for "Insurance Requirements for Rideshare Drivers: What You Need to Know"