Flood Insurance for Homeowners: Everything You Need to Know

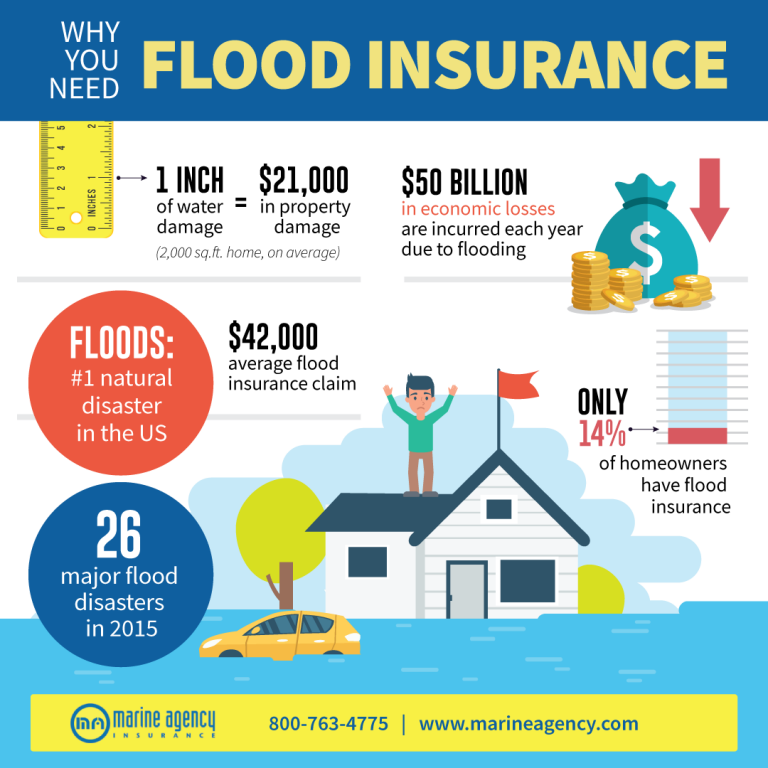

As a homeowner, protecting your property from unforeseen disasters is crucial, and one such disaster is flooding. While homeowners insurance covers several perils, it typically excludes flood damage. This is where flood insurance steps in to provide the necessary financial protection. In this comprehensive blog article, we will delve into the intricacies of flood insurance for homeowners, offering valuable insights and guidance to help you make informed decisions.

From understanding the basics of flood insurance to exploring its coverage options, we will leave no stone unturned. Whether you reside in a high-risk flood zone or a moderate-risk area, obtaining flood insurance can save you from immense financial burdens in the event of a flood. So, let's dive in and discover all there is to know about flood insurance for homeowners.

What is Flood Insurance?

Summary: Here, we will explain the concept of flood insurance and its purpose. We will outline the key differences between homeowners insurance and flood insurance, emphasizing the importance of having both.

When it comes to safeguarding your home, standard homeowners insurance may not be enough to protect your property from the damages caused by flooding. Flood insurance fills this gap by providing coverage specifically for damages caused by floods. It is a separate insurance policy that covers losses due to flood-related incidents, such as heavy rain, overflowing rivers, or coastal storms.

It's important to note that flood insurance is different from homeowners insurance in terms of coverage. While homeowners insurance typically covers damages caused by fire, theft, or windstorms, it usually excludes flood damage. This means that without flood insurance, you would be responsible for covering the costs of repairing or rebuilding your home if it were damaged by a flood. Therefore, having both homeowners insurance and flood insurance is crucial to ensure comprehensive protection for your property.

The Importance of Flood Insurance

Flood insurance is essential for homeowners, regardless of whether they live in a high-risk flood zone or not. Floods can occur anywhere, and even areas with a relatively low risk of flooding can experience unexpected events that lead to significant water damage. By having flood insurance, you can protect your home and personal belongings, ensuring that you have the necessary financial resources to recover from a flood-related disaster.

Moreover, obtaining flood insurance is often a requirement for homeowners who live in high-risk flood zones and have mortgages backed by federally regulated or insured lenders. This requirement is in place to protect both homeowners and lenders from the potential financial devastation caused by flooding. Therefore, even if you're not necessarily located in a high-risk area, it's still advisable to consider purchasing flood insurance to protect your investment.

Understanding Flood Zones and Risk Levels

Summary: In this section, we will explore the different flood zones and risk levels determined by the Federal Emergency Management Agency (FEMA). We will help homeowners identify their flood risk and explain how it affects their insurance premiums.

Flood zones are geographical areas that FEMA has categorized based on the likelihood of flooding. These zones are determined by various factors, including historical flood data, topography, rainfall patterns, and proximity to bodies of water. By understanding the flood zone in which your property is located, you can assess the level of risk and take appropriate measures to protect your home.

High-Risk Flood Zones

High-risk flood zones, also known as Special Flood Hazard Areas (SFHAs), are areas that have a higher likelihood of flooding. These zones are typically located near bodies of water, such as rivers, lakes, or coastlines. Properties in high-risk flood zones are more susceptible to flood damage, and homeowners in these areas are often required to have flood insurance by their mortgage lenders.

Properties located in high-risk flood zones face a greater risk of flooding and therefore tend to have higher flood insurance premiums. These premiums take into account factors such as the property's elevation, the flood zone it is situated in, and the proximity to water sources. However, even though flood insurance may be more expensive for homeowners in high-risk flood zones, it is a necessary investment to protect against potential financial losses.

Moderate- to Low-Risk Flood Zones

Properties located in moderate- to low-risk flood zones have a lower probability of flooding compared to high-risk flood zones. However, it's important to note that this does not mean these areas are completely immune to floods. Flooding can still occur due to heavy rainfall, localized storms, or other unforeseen circumstances.

While flood insurance may not be mandatory for homeowners in moderate- to low-risk flood zones, it is still highly recommended. The cost of flood insurance in these areas is typically lower than in high-risk zones, making it a more affordable option for homeowners. By obtaining flood insurance, homeowners can protect themselves from unexpected flood-related expenses and have peace of mind.

Types of Flood Insurance Policies

Summary: We will shed light on the two main types of flood insurance policies available for homeowners: the National Flood Insurance Program (NFIP) and private flood insurance. We will compare their coverage, cost, and eligibility criteria, enabling readers to choose the most suitable option.

When it comes to flood insurance, homeowners have two primary options: the National Flood Insurance Program (NFIP) and private flood insurance. Understanding the differences between these two types of policies can help homeowners make an informed decision based on their specific needs and circumstances.

National Flood Insurance Program (NFIP)

The NFIP is a federal program administered by FEMA that provides flood insurance coverage for homeowners, renters, and business owners in participating communities. The NFIP aims to reduce the impact of flooding by promoting the adoption of floodplain management regulations and offering affordable flood insurance options.

One of the key advantages of the NFIP is that it offers coverage for both the structure of the home and its contents. This means that not only is the physical structure of your home protected, but your personal belongings are also covered in the event of a flood. The NFIP sets coverage limits for residential properties up to $250,000 for the structure and up to $100,000 for personal belongings.

Private Flood Insurance

In addition to the NFIP, homeowners also have the option to purchase flood insurance from private insurance companies. Private flood insurance policies are not backed by the government but are provided by private insurers who set their own terms and coverage limits.

Private flood insurance can offer homeowners additional coverage options and higher coverage limits compared to the NFIP. Some private insurers may also provide coverage for additional living expenses if you are temporarily displaced from your home due to a flood. However, it's important to note that private flood insurance may not be available in all areas, especially in high-risk flood zones where the NFIP is the primary option.

Choosing the Right Policy

When deciding between the NFIP and private flood insurance, homeowners should carefully consider their specific needs and circumstances. Factors such as the property's location, flood risk, desired coverage limits, and budget should be taken into account.

For homeowners in high-risk flood zones, the NFIP is often the most accessible and affordable option. However, homeowners in moderate- to low-risk flood zones may have more flexibility in choosing between the NFIP and private insurance. Researching and comparing different policies, coverage limits, and premiums can help homeowners make an informed decision and select the flood insurance policy that best meets their needs.

Coverage and Exclusions

Summary: Here, we will delve into the specifics of what flood insurance covers and what it doesn't. From structural damage to personal belongings, we will outline the extent of coverage provided by flood insurance policies, ensuring homeowners have a clear understanding.

Understanding what is covered by your flood insurance policy is essential to ensure you have the necessary protection in the event of a flood. Flood insurance typically covers two main areas: the structure of your home and its contents. However, it's important to note that there are certain exclusions and limitations to coverage that homeowners should be aware of.

Structure Coverage

Flood insurance policies provide coverage for the physical structure of your home, including the foundation, walls, and electrical systems, among other components. This coverage extends to both the main building and any attached structures, such as garages or sheds.

When determining the coverage limit for the structure, it's important to note that flood insurance policies have set limits. For residential properties, the NFIP provides coverage up to $250,000 for the structure. Private flood insurance policies may offer higher coverage limits, depending on the insurer and policy terms.

Content Coverage

In addition to covering the structure of your home, flood insurance also provides coverage for your personal belongings that are damaged or destroyed by a flood. This includes items such as furniture, appliances, clothing, and electronics.

Similar to the coverage for the structure, flood insurance policies have set limits for content coverage. The NFIP offers up to $100,000 in coverage for personal belongings. Private flood insurance policies may offer higher coverage limits, depending on the insurer and policy terms.

Exclusions and Limitations

While flood insurance provides valuable coverage, there are certain exclusions and limitations that homeowners should be aware of. Some common exclusions include damage caused by sewer backups, moisture or mildew that could have been prevented, and currency or valuable papers.

It's also important to note that flood insurance does not cover additional living expenses if youare temporarily displaced from your home due to a flood. This means that if you need to stay in a hotel or rent another property while your home is being repaired, those expenses would not be covered by flood insurance.

Furthermore, flood insurance typically does not cover damage to landscaping, swimming pools, or detached structures that are not used for residential purposes. It's important to carefully review your policy and understand the specific exclusions and limitations to ensure you have realistic expectations of what will be covered in the event of a flood.

It's worth noting that some private flood insurance policies may offer additional coverage options and lower deductibles compared to the NFIP. Private policies may also provide coverage for additional living expenses, as well as coverage for high-value items such as artwork or jewelry. However, it's important to carefully review the terms and conditions of any private flood insurance policy to fully understand the coverage and exclusions.

To ensure you have adequate coverage for your specific needs, it's recommended to consult with an insurance professional who can guide you through the process and help you choose the right flood insurance policy. They can assess your property, evaluate your flood risk, and provide personalized recommendations based on your circumstances.

Determining the Cost of Flood Insurance

Summary: In this section, we will discuss the factors that influence the cost of flood insurance, including location, elevation, and flood history. By providing insights into the pricing structure, we aim to help homeowners estimate their potential premiums.

The cost of flood insurance can vary depending on several factors, including the location of your property, its elevation, and its flood history. Understanding these factors can help homeowners estimate their potential premiums and budget accordingly.

Location

One of the primary factors that influence the cost of flood insurance is the location of your property. Homes located in high-risk flood zones, where the likelihood of flooding is higher, generally have higher premiums compared to homes in moderate- to low-risk flood zones.

Flood zone maps, such as those provided by FEMA, categorize areas based on their flood risk. These maps are used by insurance companies to assess the risk associated with insuring a property. The higher the risk, the higher the premium is likely to be.

Elevation

The elevation of your property in relation to the base flood elevation (BFE) can also impact the cost of flood insurance. The BFE is the level at which floodwaters are expected to rise during a base flood event, which is a flood with a 1% chance of occurring in any given year.

Homes located below the BFE are considered to be at a higher risk and may face higher insurance premiums. On the other hand, homes located above the BFE are generally considered to be at a lower risk and may have lower premiums.

Flood History

The flood history of your property and the surrounding area can also influence the cost of flood insurance. If the area has a history of frequent floods or significant flood damage, insurance companies may consider it to be at a higher risk and charge higher premiums.

Insurance companies assess flood history by examining past claims data and historical flood events in the area. If your property has experienced previous flood damage or has made previous flood insurance claims, it may impact the cost of your premiums.

Other Factors

In addition to location, elevation, and flood history, there are other factors that can influence the cost of flood insurance. These factors may include the age and construction of your home, the coverage limits you choose, and the deductible you select.

Newer homes or homes built to specific flood-resistant standards may be eligible for lower premiums. Similarly, higher coverage limits and lower deductibles may result in higher premiums. It's important to carefully consider these factors and determine the level of coverage that best suits your needs and budget.

How to Purchase Flood Insurance

Summary: This section will guide readers through the process of purchasing flood insurance. We will explain the necessary steps, including contacting insurance agents, obtaining quotes, and understanding the policy terms and conditions.

Purchasing flood insurance is a straightforward process, and there are several steps you can follow to ensure you obtain the right coverage for your needs. Here is a step-by-step guide to help you navigate the process:

Step 1: Evaluate Your Flood Risk

The first step in purchasing flood insurance is to assess your flood risk. You can do this by reviewing flood maps provided by FEMA or consulting with your insurance agent. Understanding your flood risk will help you determine the appropriate coverage and policy options for your property.

Step 2: Contact Your Insurance Agent

Once you have evaluated your flood risk, reach out to your insurance agent to discuss your flood insurance needs. They will be able to provide you with information about available policies, coverage options, and premiums specific to your property.

Step 3: Obtain Quotes

Request quotes from multiple insurance providers to compare coverage options and premiums. This will help you find the best policy that meets your needs and fits within your budget. Be sure to provide accurate information about your property and flood risk to receive accurate quotes.

Step 4: Understand Policy Terms and Conditions

Before finalizing your purchase, carefully review the terms and conditions of the flood insurance policy. Pay attention to coverage limits, deductibles, and any exclusions or limitations. If you have any questions or concerns, don't hesitate to ask your insurance agent for clarification.

Step 5: Purchase and Maintain Coverage

Once you have selected a policy that meets your needs, purchase flood insurance and make sure to maintain coverage. Pay your premiums on time and keep your policy information readily accessible. It's also a good idea to periodically review your coverage to ensure it aligns with any changes in your property or flood risk.

Making a Flood Insurance Claim

Summary: In the unfortunate event of a flood, homeowners need to know how to navigate the claims process. Here, we will provide a step-by-step guide on making a flood insurance claim, ensuring homeowners are well-prepared and informed.

When a flood damages your property, it's important to take prompt action and initiate the claims process as soon as possible. Here is a step-by-step guide to help you navigate the process of making a flood insurance claim:

Step 1: Ensure Safety and Mitigate Further Damage

Prioritize your safety and the safety of others. If your home has been damaged by a flood, take necessary precautions to avoid hazards or potential risks. If it's safe to do so, take steps to prevent further damage, such as turning off the electricity and removing valuables from the affected areas.

Step 2: Document the Damage

Thoroughly document the damage caused by the flood. Take photos or videos of the affected areas and items to provide visual evidence of the damage. This documentation will be crucial when filing your claim and working with the insurance adjuster.

Step 3: Contact Your Insurance Provider

Notify your insurance provider as soon as possible to initiate the claims process. Have your policy information ready, and be prepared to provide details about the flood event and the extent of the damage. Your insurance provider will guide you through the next steps and provide instructions on what information or documentation they require.

Step 4: Meet with an Adjuster

Once you have filed your claim, an insurance adjuster will be assigned to assess the damage and determine the coverage and compensation. Schedule an appointment with the adjuster to inspect your property and provide them with any documentation or evidence you have collected.

Step 5: Review and Negotiate the Claim

Review the adjuster's assessment and the proposed claim settlement. If you believe the settlement does not adequately cover the damages, you have the right to negotiate with your insurance provider. Provide any additional evidence or documentation that supports your claim for a fair settlement.

Step 6: Receive Compensation

If your claim is approved, you will receive compensation for the covered damages. The amount and timing of the compensation will depend on your policy and the specific terms and conditions. Ensure that you understand how the payment will be processed and any applicable deductibles that may be deducted from the settlement.

Mitigation Measures for Flood Prevention

Summary: Prevention is always better than cure. In this section, we will discuss various measures homeowners can take to minimize the risk of flooding. From landscaping techniques to installing flood-resistant materials, we will offer practical tips for flood prevention.

While flood insurance provides financial protection after a flood has occurred, taking preventive measures can help minimize the risk and potential damage caused by flooding. Here are some mitigation measures homeowners can consider to prevent or reduce flood-related risks:

Elevate Your Home

Consider elevating your home above the base flood elevation (BFE) to reduce the risk of flood damage. This can be achieved through various methods, such as raising the foundation, installing flood vents, or using stilts or pilings. Consult with a professional contractor or engineer to determine the best elevation strategy for your property.

Improve Drainage Systems

Ensure that your property's drainage systems, such as gutters, downspouts, and drains, are properly installed and functioning effectively. Regularly clean and maintain these systems to preventwater from pooling or accumulating near your home. Consider installing additional drainage features, such as French drains or swales, to redirect water away from your property.

Seal and Waterproof

Seal any cracks or gaps in your home's foundation, walls, and windows to prevent water from seeping in during a flood. Consider applying waterproof coatings or sealants to vulnerable areas, such as basement walls or the foundation, to provide an extra layer of protection against water intrusion.

Install Flood Barriers or Floodproofing Systems

Consider installing flood barriers, such as flood gates or flood panels, to protect vulnerable entry points, such as doors and windows, during a flood. These barriers can help prevent water from entering your home and causing damage. Additionally, explore floodproofing systems, such as sump pumps or backflow valves, to mitigate the risk of water entering your property.

Landscape with Flood-Resistant Plants

Choose flood-resistant plants and landscaping materials that can withstand excess water. These plants have deep root systems that help absorb water and prevent erosion. Additionally, avoid planting trees or shrubs too close to your home's foundation, as their roots can potentially damage the foundation or create pathways for water to enter.

Secure Outdoor Items

Secure outdoor furniture, equipment, and other items that can be easily swept away by floodwaters. Anchor or tie down these items to prevent them from becoming hazards during a flood. Consider storing valuable or irreplaceable items in elevated storage areas or on higher floors of your home.

Stay Informed and Prepared

Keep yourself informed about local weather conditions and flood risks in your area. Sign up for emergency alerts and be prepared to evacuate if necessary. Create an emergency kit that includes essential supplies, such as food, water, medications, and important documents, in case of a flood emergency.

Additional Resources and Assistance

Summary: We will compile a list of helpful resources and assistance programs available to homeowners seeking further information or financial support for flood insurance. This section will include links to government websites, nonprofit organizations, and other relevant sources.

When it comes to flood insurance and flood prevention, there are various resources and assistance programs available to homeowners. These resources provide valuable information, guidance, and, in some cases, financial support. Here are some helpful resources to consider:

National Flood Insurance Program (NFIP)

The NFIP, administered by FEMA, offers comprehensive information about flood insurance, flood maps, and floodplain management. Their website provides resources for homeowners, including information on policy coverage, premium rates, and flood risk assessment tools. Visit their website at www.floodsmart.gov for more details.

Floodsmart

Floodsmart is a consumer education initiative by the NFIP that aims to increase awareness about flood risks and the importance of flood insurance. Their website offers resources, interactive tools, and frequently asked questions to help homeowners understand flood insurance and make informed decisions. Visit www.floodsmart.gov for more information.

Your Insurance Provider

Contact your insurance provider to inquire about additional resources or assistance programs they may offer. They can provide information specific to your policy, coverage options, and any available discounts or incentives for flood mitigation measures.

Local Government Agencies

Contact your local government agencies, such as your city or county's emergency management department, for information on local floodplain management regulations, flood maps, and assistance programs. They can provide guidance on flood prevention measures and potentially connect you with resources in your area.

Nonprofit Organizations

There are several nonprofit organizations that focus on flood prevention, community resilience, and disaster response. These organizations may offer educational resources, workshops, and assistance programs for homeowners. Examples include the Red Cross, the National Flood Association, and local community flood response organizations.

Financial Assistance Programs

In certain cases, financial assistance may be available to homeowners for flood mitigation measures or insurance premiums. Research federal, state, or local programs that provide grants, loans, or subsidies for flood-related expenses. These programs may have specific eligibility criteria, so be sure to review the requirements and application process.

Frequently Asked Questions

Summary: In the final section, we will address commonly asked questions about flood insurance for homeowners. By providing clear and concise answers, we aim to alleviate any lingering doubts or concerns that readers may have.

1. Is flood insurance mandatory for all homeowners?

Flood insurance is typically mandatory for homeowners in high-risk flood zones with mortgages backed by federally regulated or insured lenders. However, it's highly recommended for homeowners in moderate- to low-risk flood zones as well to protect their investment.

2. Can I purchase flood insurance if I don't have a mortgage?

Yes, you can purchase flood insurance even if you don't have a mortgage. It's a wise decision to protect your property and belongings from potential flood damage.

3. Will flood insurance cover damage caused by sewer backups?

No, flood insurance typically does not cover damage caused by sewer backups. However, you may be able to obtain separate coverage for this specific risk through your homeowners insurance or a separate sewer backup insurance policy.

4. Can I purchase flood insurance after a flood occurs?

No, flood insurance policies generally have a waiting period before coverage becomes effective. It's important to purchase flood insurance before a flood occurs to ensure you have the necessary protection in place.

5. Are there any discounts available for flood insurance premiums?

Some insurance providers offer discounts for flood insurance premiums if certain flood mitigation measures are implemented, such as elevating your home or installing flood barriers. Contact your insurance provider to inquire about available discounts.

6. Can I cancel my flood insurance policy if I no longer want it?

Yes, you can cancel your flood insurance policy if you no longer want or need the coverage. However, it's important to consider the potential risks and consult with your insurance provider before making a decision.

To safeguard your home and financial stability, investing in flood insurance is a prudent choice. By understanding the ins and outs of flood insurance for homeowners, you can make well-informed decisions and secure your property from the devastating effects of flooding. Remember, preparation is key, and flood insurance serves as a vital protective measure against the unpredictable forces of nature. Stay informed, stay protected!

Post a Comment for "Flood Insurance for Homeowners: Everything You Need to Know"