Critical Illness Insurance Coverage Explained: Comprehensive Guide and Benefits

In today's uncertain world, protecting ourselves and our loved ones from unexpected health crises is a top priority. One way to achieve this peace of mind is through critical illness insurance coverage. This blog article aims to provide a comprehensive and detailed understanding of critical illness insurance, its benefits, and how it works.

Understanding the basics of critical illness insurance is essential before diving into the specifics. This coverage is designed to provide financial support in the event of a severe illness diagnosis. It offers a lump sum payment that can be used to cover medical expenses, ongoing treatment costs, recuperation aids, or even to replace lost income during the recovery period.

What is Critical Illness Insurance?

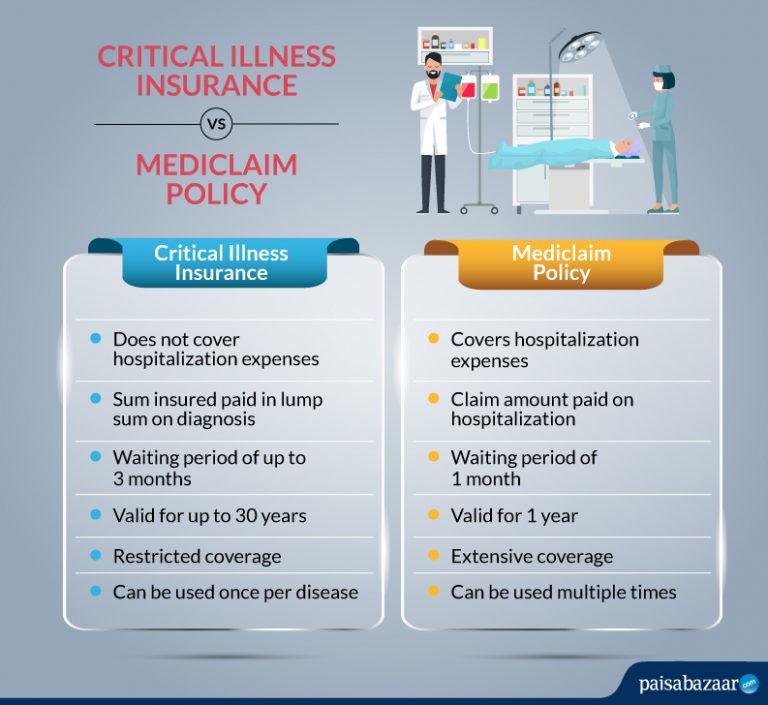

Critical illness insurance is a specialized form of insurance that provides financial protection by offering a lump sum payment upon diagnosis of a covered critical illness. Unlike traditional health insurance, which typically covers medical expenses and hospitalization costs, critical illness insurance provides policyholders with a lump sum payment that can be used as they see fit. This flexible payout allows individuals to cover a wide range of expenses, including medical treatments not covered by their health insurance, mortgage or rent payments, household bills, or even to take a much-needed family vacation during the recovery period.

Importance of Critical Illness Insurance

Having critical illness insurance is crucial because it provides a safety net during a challenging time. A severe illness can have a significant financial impact, with medical bills, specialized treatments, and time off work all contributing to the financial burden. Critical illness insurance helps alleviate this burden by providing a lump sum payment that can be used to cover these expenses and maintain financial stability. It allows individuals to focus on their recovery and well-being without the added stress of financial worries. Additionally, critical illness insurance can provide peace of mind to individuals and their families, knowing that they have a financial safety net in place should the unexpected occur.

Covered Illnesses and Conditions

Critical illness insurance typically covers a wide range of serious illnesses and conditions. While the specific covered illnesses may vary depending on the insurance provider and policy, some common examples include cancer, heart attack, stroke, organ transplantation, and certain types of paralysis. It is essential to carefully review the policy terms and conditions to understand which illnesses are covered and any specific requirements for a successful claim. Some policies may also offer coverage for additional illnesses or conditions as optional riders, allowing individuals to tailor their coverage to their specific needs.

Common Covered Illnesses

Critical illness insurance policies generally cover a range of serious illnesses. Cancer, including various types such as breast cancer, lung cancer, and prostate cancer, is often included in the coverage. Heart-related conditions, such as heart attack and coronary artery bypass surgery, are also commonly covered. Stroke, including both ischemic and hemorrhagic strokes, is another critical illness that is often covered. Organ transplantation, such as kidney or liver transplant, may also be included in the coverage. In some cases, paralysis resulting from accidents or specific medical conditions, such as Parkinson's disease or multiple sclerosis, may be covered as well. These are just a few examples, and it is crucial to review the policy documentation to understand the full list of covered illnesses.

Benefits and Payouts

Critical illness insurance offers various benefits to policyholders and their families. The most significant benefit is the lump sum payout provided upon diagnosis of a covered critical illness. This lump sum payment can be used to cover a wide range of expenses, including medical treatments not covered by regular health insurance, daily living expenses, mortgage or rent payments, childcare costs, or even to fund necessary lifestyle adjustments during the recovery period. The flexibility of the payout allows individuals to prioritize their needs and allocate the funds accordingly.

Determining the Payout Amount

The payout amount for critical illness insurance is determined by the policy's terms and conditions. It is typically based on the severity of the diagnosed illness or condition. Different illnesses may have different payout amounts, with more severe or life-threatening conditions generally receiving a higher payout. The payout amount is predetermined when the policy is purchased and is specified in the policy documentation. It is crucial to review these details carefully to understand the potential payout amount and how it aligns with individual needs and financial obligations.

Factors to Consider When Choosing a Policy

When selecting a critical illness insurance policy, several essential factors should be considered to ensure the right coverage is chosen. These factors can vary depending on personal circumstances and preferences, but some common considerations include coverage limits, waiting periods, and additional riders.

Coverage Limits

One of the primary considerations when choosing a critical illness insurance policy is the coverage limits. Coverage limits refer to the maximum amount that will be paid out in the event of a claim. It is important to select a policy with coverage limits that adequately meet individual needs. Consider factors such as potential medical expenses, ongoing treatment costs, and any financial obligations that need to be covered during the recovery period. It is advisable to choose a policy with higher coverage limits to ensure sufficient financial protection.

Waiting Periods

Waiting periods are an important aspect of critical illness insurance policies. A waiting period refers to the period of time that must pass after purchasing the policy before a claim can be made. It is crucial to understand the waiting period specified in the policy, as it can vary between insurance providers. Some policies may have a waiting period of a few months, while others may require a longer waiting period of one or two years. Consider personal circumstances, such as any pre-existing conditions or family history of critical illnesses, when choosing a policy with an appropriate waiting period.

Additional Riders

Additional riders are optional add-ons that can be included in a critical illness insurance policy to enhance coverage. These riders provide additional protection for specific conditions or situations not covered by the base policy. For example, a cancer-specific rider may offer additional coverage for various types and stages of cancer. Other riders may include coverage for specific treatments or procedures, such as stem cell therapy or experimental treatments. It is essential to carefully review the available riders and assess their relevance to personal circumstances when selecting a policy.

Understanding Exclusions and Limitations

While critical illness insurance provides extensive coverage, it is important to be aware of any exclusions and limitations specified in the policy. Exclusions refer to specific illnesses or conditions that are not covered by the policy, while limitations may include certain restrictions or requirements for a successful claim. Understanding these exclusions and limitations is crucial to ensure realistic expectations and prevent any surprises when making a claim.

Common Exclusions

Exclusions in critical illness insurance policies can vary between insurance providers and policies. Some common exclusions may include pre-existing conditions, self-inflicted injuries, or illnesses resulting from drug or alcohol abuse. It is important to carefully review the policy documentation to identify any exclusions that may apply. Understanding these exclusions allows individuals to make informed decisions and explore alternative coverage options if necessary.

Limitations and Requirements

Limitations and requirements in critical illness insurance policies may include restrictions on the age at which coverage can be obtained, waiting periods before a claim can be made, or specific medical criteria that must be met for a successful claim. It is essential to thoroughly review the policy terms and conditions to understand these limitations and requirements. This ensures that individuals meet the necessary criteria and are aware of any potential challenges when making a claim.

Cost of Critical Illness Insurance

The cost of critical illness insurance can vary based on several factors. Insurance providers consider factors such as age, gender, health history, lifestyle habits, and the desired coverage amount when determining the premium. It is important to understand these factors and how they can impact the cost of the insurance before purchasing a policy.

Age and Gender

Age and gender are significant factors that influence the cost of critical illness insurance. Generally, younger individuals tend to pay lower premiums compared to older individuals. This is because younger policyholders are typically considered to be at a lower risk of developing critical illnesses. Additionally, gender can also affect the cost of insurance, as certain illnesses may have a higher incidence rate among specific genders.

Health History and Lifestyle

Insurance providers assess an individual's health history and lifestyle habits to determine the risk profile. Individuals with a history of certain medical conditions or lifestyle habits such as smoking may be considered higher risk and may face higher premiums. It is important to disclose accurate and complete information during the application process to ensure that the policy is priced correctly.

Coverage Amount

The desired coverage amount also affects the cost of critical illness insurance. Higher coverage limits typically result in higher premiums. It is important to strike a balance between the desired coverage amount and the affordability of the premiums. Consider personal financial circumstances and obligations when determining the appropriate coverage amount.

How to File a Claim

Filing a claim for critical illness insurance requires careful attention to detail and adherence to the insurance provider's guidelines. Understanding the claims process and being prepared can help streamline the process and ensure a smooth experience.

Review Policy Documentation

Before filing a claim, it is essential to thoroughly review the policy documentation to understand the specific requirements and documentation needed. Familiarize yourself with the covered illnesses, waiting periods, and any exclusions or limitations that may apply. This ensures that all necessary information is gathered and the claim is filed correctly.

Gather Required Documentation

Once familiar with the policy requirements, gather all the necessary documentation to support the claim. This may include medical records, test results, physician statements, and any other relevant documents. It is crucial to ensure that all documentation is complete, accurate, and up-to-date to avoid any delays or difficulties in the claims process.

Contact the Insurance Provider

Reach out to the insurance provider's claims department to initiate the claims process. They will provide guidance on the specific steps to follow and any additional documentation required. It is important to have all the necessary information readily available when contacting the insurance provider to expedite the process.

Complete the Claim Form

Most insurance providers will require a claim form to be completed. This form collects important details about the policyholder, the diagnosed illness, and the treatment received. Be thorough and accurate when completing the form, providing all the necessary information requested. Any missing or incomplete information may result in delays in processing the claim.

Submit the Claim and Supporting Documentation

Once the claim form is completed, submit it along with all the supporting documentation to the insurance provider. Ensure that all documents are properly organized and clearly labeled to facilitate the claims review process. Consider sending the claim via certified mail or using a secure online portal, if available, to track the progress and ensure receipt.

Follow Up on the Claim

After submitting the claim, it is essential to follow up with the insurance provider regularly to check on the progress and address any outstanding requirements or inquiries. Stay in contact with the claims department and promptly provide any additional information or documentation they may request. This proactive approach can help expedite the claims process and ensure a smooth resolution.

Alternatives to Critical Illness Insurance

While critical illness insurance provides comprehensive coverage, it may not be suitable for everyone or fit within specific budget constraints. Exploring alternative insurance options can provide additional financial protection and peace of mind. Consider the following alternatives to critical illness insurance:

Disability Insurance

Disability insurance provides income protection in the event of a disabling illness or injury that prevents an individual from working. Unlike critical illness insurance, which focuses on specific illnesses, disability insurance covers a broader range of conditions that may affect an individual's ability to work. It offers regular income replacement, typically a percentage of the individual's pre-disability earnings, helping to maintain financial stability during the recovery period.

Long-Term Care Insurance

Long-term care insurance is designed to cover the costs associated with long-term care services, such as nursing home care, assisted living facilities, or in-home care. It provides financial protection for individuals who may require assistance with daily activities due to chronic illnesses, disabilities, or cognitive impairments. Long-term care insurance can help protect assets and preserve financial independence in the face of long-term care expenses.

Health Insurance

While critical illness insurance focuses on providing financial support for specific severe illnesses, health insurance offers broader coverage for medical expenses and hospitalization. It is essential to have comprehensive health insurance coverage to meet day-to-day medical needs and ensure access to necessary treatments and procedures. Health insurance can provide financial protection against unexpected medical costs and ongoing healthcare needs.

Tips for Choosing the Right Provider

Selecting a reputable and reliable insurance provider is crucial when purchasing critical illness insurance. Consider the following tips to ensure a positive experience and comprehensive coverage:

Research the Provider's Reputation

Before committing to an insurance provider, research their reputation and financial stability. Look for reviews, ratings, and testimonials from policyholders to gauge their overall customer satisfaction. A financially stable and reputable provider is more likely to deliver on their promises and provide reliable support when needed.

Compare Policy Features and Options

Different insurance providers offer varying policy features, coverage limits, and additional riders. Take the time to compare policies from multiple providers to understand the range of coverage options available. Consider factors such as covered illnesses, waiting periods, coverage limits, and any optional riders that may be relevant to personal needs.

Consider Customer Service and Claims Process

A provider with a strong customer service track record and an efficient claims process can make a significant difference in the overall insurance experience. Look for providers that prioritize customer satisfaction and have a streamlined claims process. Consider reaching out to their customer service department with any questions or concerns to gauge their responsiveness and willingness to assist.

Seek Professional Advice

If navigating the world of insurance feels overwhelming, consider seeking professional advice from an insurance broker or financial advisor. These experts can provide personalized recommendations based on individual needs, preferences, and budget constraints. They can help navigate the various policy options and assist in selecting the most appropriate coverage.

Frequently Asked Questions

Q: Is critical illness insurance the same as health insurance?

A: No, critical illness insurance is different from health insurance. Health insurance covers medical expenses and hospitalization, while critical illness insurance provides a lump sum payment upon diagnosis of a covered critical illness.Q: Can I use the lump sum payment from critical illness insurance for any purpose?

A: Yes, the lump sum payment from critical illness insurance can be used for various purposes, such as medical treatments, ongoing expenses, mortgage or rent payments, or even to replace lost income during the recovery period.Q: What happens if I am diagnosed with a critical illness that is not covered by my policy?

A: If a critical illness is not covered by your policy, you will not be eligible for a payout. It is crucial to review the policy terms and conditions to understand which illnesses are covered before purchasing a policy.Q: Can I purchase critical illness insurance if I have pre-existing conditions?

A: Some insurance providers may offer coverage for pre-existing conditions, while others may have limitations or exclusions. It is important to disclose any pre-existing conditions and review the policy terms and conditions to understand the coverage available.Q: Can I cancel my critical illness insurance policy if I change my mind?

A: Yes, most critical illness insurance policies have a free-look period during which you can cancel the policy and receive a full refund of premiums paid. The duration of the free-look period may vary between insurance providers.In conclusion, critical illness insurance coverage provides essential financial protection in the event of a severe illness diagnosis. Understanding the basics, such as covered illnesses, benefits, and the claims process, is crucial when selecting a policy. Considering alternative insurance options and choosing a reputable provider can further enhance financial protection. It is advisable to seek professional advice and review multiple policy options to ensure the most suitable coverage is obtained. Remember to regularly review and update the policy as personal circumstances change to maintain comprehensive protection.

Post a Comment for "Critical Illness Insurance Coverage Explained: Comprehensive Guide and Benefits"